I’m Ted Bauman, an economist and editor of numerous publications at Banyan Hill, including Bauman Daily.

When the team at Money & Markets reached out to ask if I’d share some of my insights here, I didn’t give it second thought.

I’ve spent my career helping people secure their wealth and find sources of steady income — especially in uncertain times such as now. It’s times like these that my background as an economic historian gives me unique insight … and even more enthusiasm to share that with you.

That’s what we do at Bauman Daily, a publication that has also spurred a series of wildly popular YouTube videos. We’ve had an overwhelmingly positive response from viewers who are increasingly heading to the comments section to debate my takes on the stock market and economy. Feel free to join the conversation and our 14,000-plus subscribers.

As investors, it’s important to take stock of the economy to protect profits and secure our future financial freedom.

Find Real Profits in the Real Economy

I’m a conservative investor.

I don’t mind a little speculation here and there. But my approach is to look for companies that generate big profits by efficiently producing goods and services people need in the real world. As those companies increase their earnings, they increase their share prices.

One advantage of that approach is that if a company’s strategy is on track, you don’t need to worry too much about its stock price. It may waver up and down with the overall market, but if it’s a solid business, it’s going to rise over time.

By contrast, speculative betting on short-term stock price movements is a high-maintenance activity. Especially now.

Until late February, growth stocks were all the rage. It didn’t matter whether companies made any profits as long as everybody was talking about them.

But when the COVID-19 crisis hit, most of those stocks saw steep declines. Ever since, the market has been sustained by the mega-cap technology giants and pharmaceuticals. Growth stocks are being punished.

That leaves many of us wondering what to do with our existing portfolios.

3 Actions You Can Take Now to Protect Profits and Make Gains

In one of my recent YouTube videos, I gave step-by-step advice about exactly that.

No. 1: Cull the Herd

“Growth” companies with solid business models and links to virus-proof economic sectors are already rebounding. Those you can leave alone … or even buy more shares to lower your average cost basis.

Then there are companies whose price appreciation was based on pure speculative buzz (I’m looking at you, Uber.) They’re getting hammered and if you own them, you should cut your losses. We’re in a different world now. As hard as it is to stomach, now is an appropriate time to cull your portfolio to generate cash for better opportunities down the road.

No. 2: Take Profits

Of course, other stocks have seen pullbacks from all-time highs but are still in positive territory. What about those?

If they’re outpacing the market right now, leave them alone and let them run. But if they’ve pulled back and appear to be consolidating, trading sideways with no gains week after week, take profits.

By “taking profits,” I don’t mean selling your entire position. I mean selling back to the value of your original investment.

Let’s say you bought 100 shares of XYZ at a dollar a share. XYZ is now trading at $1.50 a share. That means you have a paper gain of $50. $50 divided by $1.50 equals just over 33 shares. Sell those 33 shares to protect profit, keep the rest, and put that profit to better use.

No. 3: Find Steady, Quality Yields

To me, that “better use” is scooping up shares in high-quality dividend paying companies. I say that for two reasons.

First, buying companies for their dividend is what I consider “investment.” You’re taking an ownership stake in a business to share in its profits. It’s at the other end of the spectrum from share price speculation.

For most people — those who don’t have limitless capital to invest — it’s the strategy they should always pursue to optimize risk and reward.

But second, right now, people fear dividend-paying companies. And that’s pushed their prices down indiscriminately.

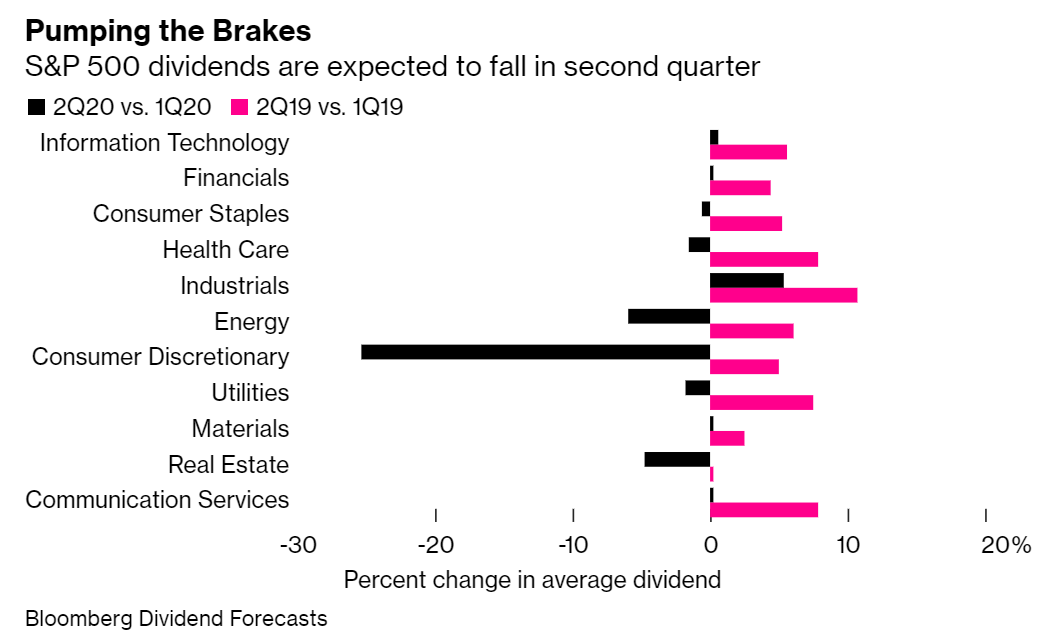

They’ve heard horror stories of big names like Harley-Davidson, General Motors and Starbucks suspending their dividends. They’ve seen articles pointing out that dividend futures contracts trading on the Chicago Mercantile Exchange suggest the combined S&P 500 dividend will fall by 27% by next year.

But dividends aren’t going to fall equally across all sectors. The chart below shows that companies in information technology, finance, materials, communication services, and above all industrial stocks are expected to rise this year:

Of course, not every company in those sectors will maintain or increase their dividends, but there are solid economic reasons why dividends are more protected there than in other sectors.

But many — probably most — investors don’t know that. They’re just avoiding dividend-payers altogether.

That’s driving their prices down indiscriminately … and creating a unique opportunity to lock in high future yields on cost. Yield on cost is the yield you get as a percentage of the price you paid for the stock. The less you pay for a stock, the higher your future yield on cost will be.

Lock in Double-Digit Yields Now

I’ve used just that sort of analysis to target a company for the most recent pick in my Bauman Letter monthly report. I looked at the demand for the company’s product in the context of the pandemic. I examined its financials, especially its extremely low debt. I considered its history of dividend increases, which is significantly above average. I looked at its current price multiples compared to its historic average, and to its peers.

My conclusion was that buying this company now creates the possibility of as much as 10% yield on cost within three to five years. That’s because the company is positioned to benefit from the COVID 19 crisis, it tends to increase dividends, and it’s trading at a significant discount to fair valuation.

For more information about The Bauman Letter, click here.

With long-term treasury yields hovering at around 0.6%, and Fed money-printing pushing down corporate bond yields to absurdly low levels, a 10% yield on cost is outstanding. Real investors should want to grab it as quickly as they possibly can.

To take my advice. Cull your losers, take profits on some of your winners, and put that money to work setting you up for the best yields you’ll see for years to come.

Ted Bauman

• Ted Bauman is the Editor of The Bauman Letter, Bauman Daily, 10X Project and Alpha Stock Alert for Banyan Hill Publishing. He is a renowned economist and economic historian, and an expert in risk-optimized investing. He is regularly quoted by top financial publications like Barron’s, Forbes, MarketWatch, The Guardian and Benzinga. Mr. Bauman has also published his own book, “Endless Income,” and co-authored “Where to Stash Your Cash (Legally),” which he wrote with his father, former U.S. Rep. Robert Bauman.

Follow him on Twitter @BaumanDaily and subscribe to his YouTube channel.