Buying a semiconductor stock or two is a no-brainer this year.

Throughout 2021, the industry dominated headlines as companies wrestled with a busted supply chain and surging demand.

You’ll find semiconductors in thousands of electronic devices, from cars and smartphones to appliances and gaming hardware. Think of any modern piece of technology, and it’s a safe bet that these tiny chips help it tick.

But this tech goes beyond your smartphone or 2022 Lexus. It’s EVERYWHERE.

In a 2021 report, Goldman Sachs noted 169 industries affected by the semiconductor shortage. Everything from wineries to plastic production felt the crunch.

And it creates a lucrative situation for 2022…

Semiconductor Demand Will Remain Elevated

Here are just a couple of headlines that crossed my news feed in the last week:

- Global semiconductor sales increased 23.5% in November.

- Chip sales are set to grow 10% in 2022 as risks rise, predicts new report.

Last year, the semiconductor industry grew a massive 26% to $553 billion, according to credit insurer Euler Hermes.

That growth is a little inflated due to heightened demand as companies scrapped to get their hands on any supply available. But Euler Hermes is bullish on 2022, forecasting that growth to top $600 billion this year.

Risks include lower demand for hardware. If you bought a TV or a computer in 2021, what are the chances you’re in the market for a new one in 2022? And ongoing tensions between the U.S. and China could threaten skyrocketing growth.

But even if that estimate is generous, we’re looking at hundreds of billions of dollars in demand … and that’s the kind of mega trend we at Money & Markets follow!

Find Profits in the Semiconductor Space

Semiconductor ETFs

If you want to ride this trend throughout 2022, but you don’t want to dig too deep, exchange-traded funds (ETFs) are a solid option.

Funds like the iShares Semiconductor ETF (Nasdaq: SOXX) and the VanEck Semiconductor ETF (Nasdaq: SMH) offer broad exposure to the industry.

And these funds hold large shares of the big names including Broadcom Inc. (Nasdaq: AVGO), Nvidia Corp. (Nasdaq: NVDA) and Advanced Micro Devices Inc. (Nasdaq: AMD).

Over the last 12 months, both funds have gained more than 30%. That beat the S&P 500’s impressive 23% gain over the same period.

Both funds offer reasonable expense ratios (annual cost paid to fund managers), with SOXX coming in at 0.43% and SMH coming it at 0.35%.

A Bullish Semiconductor Stock

If you want to drill down and buy individual companies, you have plenty of options.

I ran the individual holdings of both SOXX and SMH through Adam O’Dell’s proprietary Green Zone Ratings system to find a stock with bullish potential. And I found a winner!

Note: If you aren’t familiar with our Green Zone Ratings system, click here to read our guide. It’s a free resource that will help you find incredible stock buys.

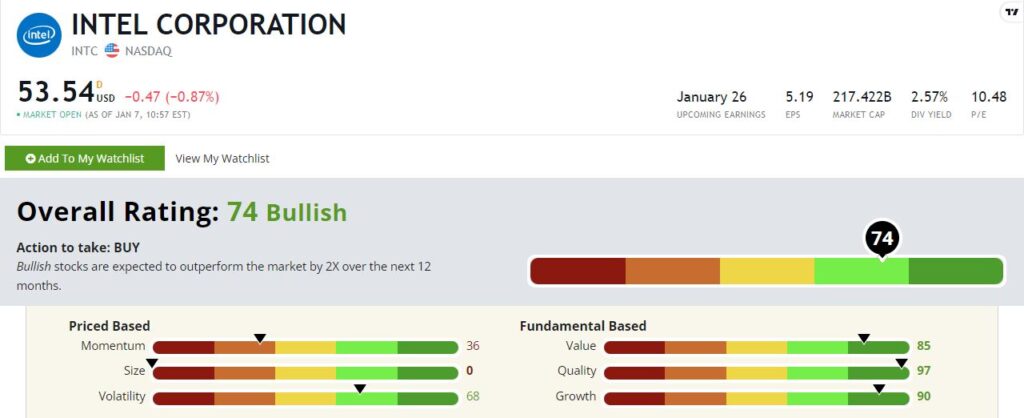

Intel Corp. (Nasdaq: INTC) is a semiconductor OG that’s been around since the 1960s. And it rates a “Bullish” 74 in Green Zone Ratings right now!

INTC only gained around 3% over the last year. That’s why its momentum score is only 36 now.

But things are looking up.

After bottoming out in late October, INTC gained around 11%. I expect that momentum score to jump as investors target downtrodden semiconductor stocks.

On top of that, INTC rates in the upper tier of more than 8,000 stocks on value, quality and growth! These fundamental factors point to a solid (and rapidly growing) business model.

Intel is an established player within the semiconductor space, and I expect it to outperform the overall market by 2X or better over the next 12 months.

Bottom line: Despite the recent tech sell-off, the future is bright for semiconductor stocks.

These tiny chips are in EVERYTHING. And as tech gets smarter, demand for more semiconductors should increase.

That’s why I think your portfolio needs semiconductor stock exposure in 2022.

A Semiconductor Stock Bonus

If you’re looking for more ways to play the semiconductor mega trend, you’ve got to check out Green Zone Fortunes today!

These tiny chips require an insane amount of precision to produce. Adam’s high-conviction recommendation is vital to this process as it manufactures the equipment companies use to create these chips. It’s the manufacturer to the manufacturer.

On top of that, it’s developing “the next big thing” in display technology.

To find out more about this recommendation and another huge mega trend Adam is following, click here to watch his “Imperium” presentation now.

Speaking of Intel… INTC was one of the biggest stocks of the 1990s as it rose more than 8,000% in 10 years during the internet stock boom. And Adam believes genomics has the potential to be bigger than the internet. Click here to see why now.

Best investing,

Chad Stone

Managing Editor, Money & Markets