Inflation is rising no matter what the experts tell us.

The latest data shows that the consumer price index (CPI) rose 5.4% in June, the largest year-over-year increase since August 2008.

The Bureau of Labor Statistics sounded like the police officer at the crime scene saying, “move along, there’s nothing to see.” As BLS noted:

“The index for used cars and trucks continued to rise sharply, increasing 10.5% in June. This increase accounted for more than one-third of the seasonally adjusted all items increase.”

Car rental prices, along with airfare costs, staying at hotels and eating at restaurants, also received blame for the outsized gain. The BLS message is that price hikes won’t affect most people since most of us don’t travel or eat out very often.

This reinforces the Federal Reserve’s message that inflation is transitory. These prices should stabilize, and they won’t drive sustained changes in the cost of living. These prices may decrease since vacations are now out of reach for many Americans.

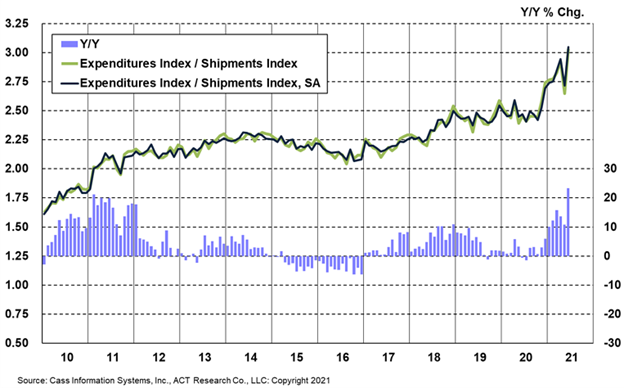

This view ignores the data in the chart below. Cass Freight Indexes use data from Cass Information Systems, a company that works with hundreds of shipping companies. The index includes data from truckers, railroads and air freight companies. It reflects information derived from about 33 million invoices that Cass processes.

Shipping Costs Are Up 10% Year Over Year

Source: Cass.

Shipping Costs Are a Major Inflation Pressure

Based on the data, Cass found shipping rates are up 10.1% compared to a year ago. Many shipping contracts are reset annually, so price increases for many companies are now locked in for the rest of the year.

Shipping costs are up 23.4% compared to last June.

Shipping costs can have a relatively large impact on consumer prices. Shipping from retailers to consumers is just one step in the supply chain. Retailers also incur shipping costs to move products from manufacturers to distribution centers. Manufacturers pay shipping costs for raw materials, and there could be several intermediate steps for manufacturing.

This is another inflationary pressure building up in the supply chain, one that many investors and economists might be overlooking.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.