One of the Federal Reserve’s primary goals is to minimize inflation. It tries to meet that goal by managing the amount of circulation and using interest rates to help define the investment environment.

Right now, interest rates are low. That should encourage businesses to invest in their operations. Low interest rates make it attractive to borrow money for new equipment or facilities that can boost sales.

If the Fed believes inflation is rising too much, it can increase interest rates. This makes it less appealing for businesses to borrow, and demand for goods and services should drop throughout the economy, reducing inflationary pressures.

Consumers behave in similar ways. They may buy more when interest rates and financing costs are low. They may delay purchases when rates are high.

Of course, that assumes the Fed holds all the power. In reality, businesses and consumers make decisions independent of the Fed. They may buy more if they think the Fed will raise rates. They may also rush to buy more if they think prices will rise.

When expectations of higher inflation develop, the Fed can lose control of the economy. That’s the Fed’s worst fear, and right now, the Fed is facing that fear.

As The Wall Street Journal recently noted: “The inflation effect of supply shocks is transitory so long as the public doesn’t expect permanently higher future inflation. Higher expectations can change wage and price-setting behavior and thus become self-fulfilling.”

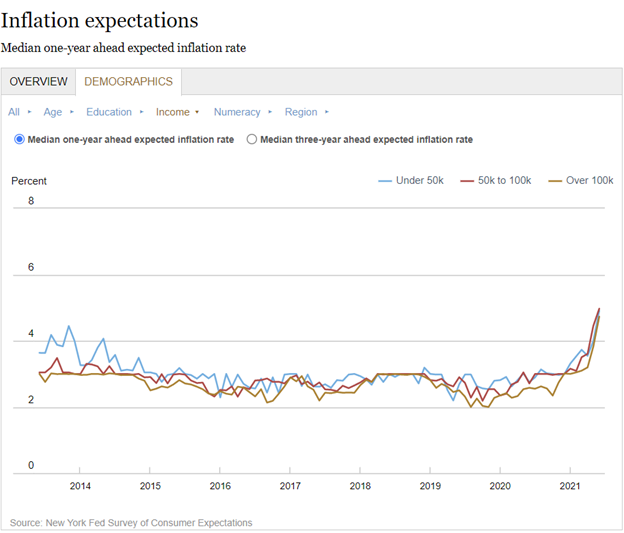

Expectations, according to the Federal Reserve Bank of New York’s Survey of Consumer Expectations, are now a cause of concern. The median year-ahead inflation expectations increased to 4.8% in June. This is the eighth consecutive monthly increase and a new high in the data.

Inflation Fear Reaches New High

Source: Federal Reserve Bank of New York.

Inflation Fear Drives Inflation

Perhaps most worrying to the Fed is that all income groups are now worried about inflation. Last month, high-income households were less concerned than lower-income households.

Low-income households tend to save less no matter what they expect. Higher-income households can rush spending if they are worried about inflation. Their fears now make it possible that spending will increase, and faster spending will increase inflation.

The Fed now faces its worst nightmare — inflation driven by fears of inflation. That’s what happened in the 1970s, and that episode led to double-digit interest rates and a decade of sluggish economic growth.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.