Russia’s invasion of Ukraine hammered the global energy markets.

Global outrage has forced countries worldwide to pivot away from Russian natural gas and oil. They don’t want to be complicit in funding the Kremlin’s attack on its neighbor.

That put pressure on natural gas prices:

This chart shows the price of 1 million British thermal units (Btu) of natural gas.

In the last 12 months, the price jumped 193.8% to an all-time high.

When supply is down (cutting off Russia) but demand is up (countries still needing natural gas for power), the price increases.

I found a unique way to play this surge in price and demand for natural gas in my high-conviction Power Stock: San Juan Basin Royalty Trust (NYSE: SJT).

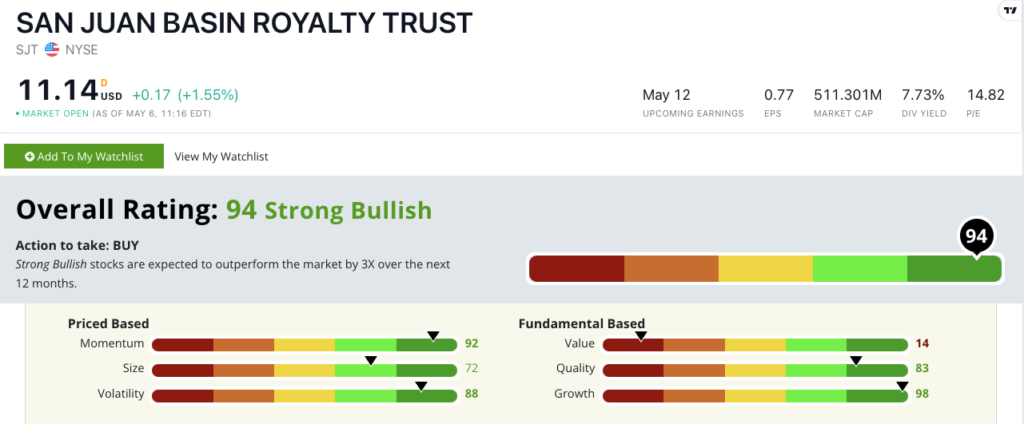

SJT Stock Power Ratings in May 2022.

SJT doesn’t own or operate any wells. It doesn’t even have employees, but it has a 75% net royalty interest in 3,800 natural gas wells in New Mexico.

A private energy company pumps natural gas out of the wells and sells it on the open market.

The company gives monthly profits from those sales to SJT, which, in turn, pays shareholders a dividend.

SJT scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SJT Stock: Top Momentum + Solid Growth Prospects

After a deeper dive into SJT, here’s what stood out:

- In 2021, SJT reported royalty income of $37.6 million compared to $8.8 million in 2020 — an increase of 327.2% in one year!

- The company pays shareholders a monthly dividend. (More on that below.)

According to our Stock Power Ratings system, SJT is a strong growth stock with positive momentum and low volatility.

Its growth numbers are unlike any I’ve seen.

Its one-year annual sales growth rate is 325.1%, and its earnings-per-share growth rate is 384.7%. SJT’s trailing 12-month and prior-quarter growth rates are also triple-digits!

It scores a 98 on our growth metric — better than just 2% of all stocks we rate!

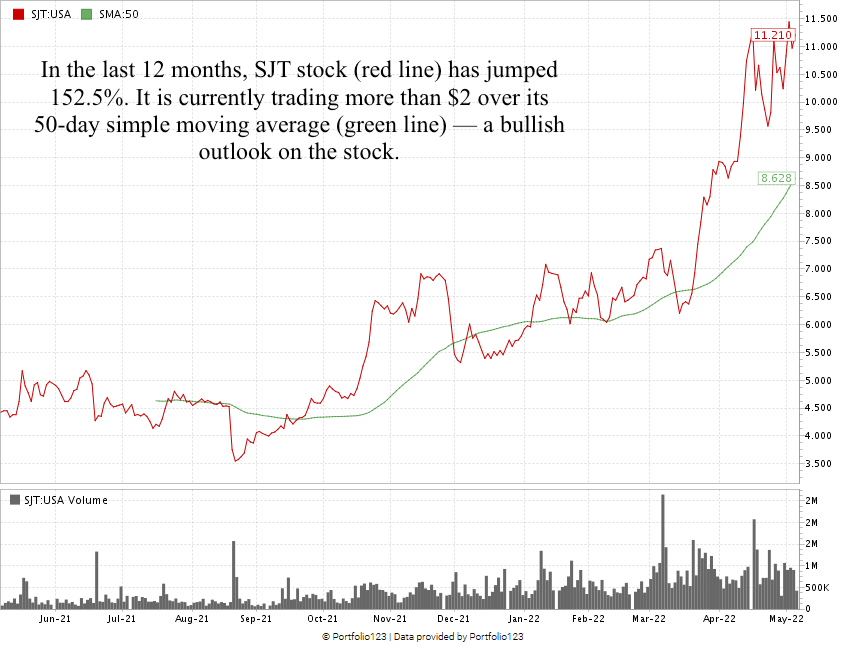

In the last 12 months, SJT stock soared 152.5% — including an 80% jump from the middle of March 2022 to May 2022.

The stock trades at more than $2 above its 50-day simple moving average — a bullish signal.

San Juan Basin Royalty Trust stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

With the global demand for natural gas increasing as the world turns away from Russian gas, companies like SJT stand to gain — without the risks of exploration or production.

Bonus: As I mentioned, the trust pays out its profits as a monthly dividend to shareholders. Its forward dividend yield is a hefty 9.07%, meaning shareholders earn an additional $0.99 per share, per year, just to hold the stock.

Stay Tuned: Insure Against Alien Abduction With This Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on an insurance stock that beats its peers by double digits, sports a healthy dividend … and insures folks against extraterrestrial events! (Yes, you read that right!)

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets