The merger that might not have been is back on, oil prices reach contango (more on that later) plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets were up for a second straight day on Tuesday’s open.

As of 9:30 a.m. Eastern time, the Dow Jones Industrial Average was up 0.18%. The S&P 500 opened up 0.3% and the Nasdaq Composite jumped 0.3% — setting the stage for another potential record.

The Opening Bell

Companies in China are starting to get back to work despite continued fears over the coronavirus outbreak.

The nation’s top cellphone maker, Huawei, reopened its headquarters in Shenzhen on Monday.

But other companies have taken a different approach to work as the death toll attributed to the virus rose to 1,016 in China as of Monday night.

Microsoft Corp. (Nasdaq: MSFT), online retail giant Alibaba Group Holding Ltd. (NYSE: BABA) and Tencent returned to operations Monday but said their employees will work from home for another week to two weeks.

Other companies have reopened as of Monday, but employees must pass through quarantine conditions in order to return to work, according to CNN Business.

Reuters reported that Foxconn employees were told to return to work at facilities in Shenzhen and Zhengzhou but only about 10% actually showed up. Foxconn is the world’s largest contract electronics manufacturer, producing the Apple Inc. (Nasdaq: APPL) iPhone.

Tesla Inc. (Nasdaq: TSLA) reopened its factory in Shanghai while General Motors (NYSE: GM) said it would not start production at its Chinese facility until Feb. 15.

Stocks to Watch Today

Calloway Golf Co. (NYSE: ELY) — Shares of the sporting goods company dropped 5.3% Tuesday morning after it reported losing $0.26 per share — more than expectations of $0.23. The company also said it expects a negative impact on future sales due to the coronavirus outbreak.

Under Armour Inc. (NYSE: UAA) — The Baltimore-based apparel maker reported a quarterly loss as well as future negative impacts on sales due to the coronavirus. Shares of Under Armour were down 13.4% in Tuesday premarket trading.

Hasbro Inc. (Nasdaq: HAS) — The toy company beat quarterly profit expectations by more than $0.25 per share but fell short of sales expectations. Hasbro shares were up 6.5% before the market opened.

In the News

Competition in the wireless wars is about to get more interesting.

Sources told The Wall Street Journal that U.S. District Judge Victor Marrero is expected to approve the merger of T-Mobile US Inc. (Nasdaq: TMUS) and Sprint Corp. (NYSE: S) in an all-stock deal worth $26 billion.

A group of state attorneys general sued to block the merger, citing it would result in higher cellphone bills — creating a case for antitrust. However, sources say the judge is set to rule against the states Tuesday.

There is no indication that Marrero will expect additional concessions from either company in his ruling.

The merger will give the new T-Mobile more than 90 million U.S. customers — more than AT&T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ). Those will comprise of the three largest wireless providers in the market.

Shares of T-Mobile were up 8% in Tuesday premarket trading while Sprint shares were up more than 65%.

Coronavirus Pushes Oil Prices Into Contango

A glut in oil supply is near as the coronavirus has impacted demand in Asia, according to Bloomberg.

That glut is suggested by the fact that Brent crude oil monthly contracts are actually cheaper each month — what’s known as contango.

Global demand estimates are slashed because of economic disruption in China over the coronavirus. Oil trading companies have started to stockpile crude oil on ships at sea.

Brent crude was up 1.3% to $53.96 a barrel in London while West Texas Crude was at $50.20 in New York as of early this morning.

The Organization of Petroleum Exporting Countries have been asked to support prices by cutting supply by another 600,000 barrels a day to get rid of the excess, however, OPEC is not slated to meet until March.

Jeff Bezos’s $4.1 Billion Sale Ends Years of Restraint

According to regulatory filings, Amazon.com Inc. (Nasdaq: AMZN) CEO Jeff Bezos sold off 2 million shares of the company — worth about $4.1 billion. It is the largest seven-day sell-off by any executive since those transactions started to be tracked in 2012, according to Bloomberg.

A big reason for the sale is likely his divorce from MacKenzie Bezos. They divorced in Washington, a community property state, meaning assets and debt are divided equally if the couple cannot reach a divorce agreement.

Under the public terms of the divorce, Jeff Bezos retains a 75% stake in Amazon as well as the couple’s ownership of The Washington Post and rocket company Blue Origin. Divorce lawyers said the couple may have agreed to a cash payment because of the uneven split.

Other Morning Reads

7 Factors of How the U.S. Economy Works (Money and Markets)

U.S. Companies Cut Back on Installing Robots in 2019 (Reuters)

Yardeni Sits on Cash Fearing 10% Coronavirus Market Correction (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Jones Lang LaSalle Inc. (NYSE: JLL)

Lyft Inc. (Nasdaq: LYFT)

Rexford Industrial Realty Inc. (NYSE: REXR)

The Western Union Co. (NYSE: WU)

Under Armour Inc. (NYSE: UA)

Chart of the Day

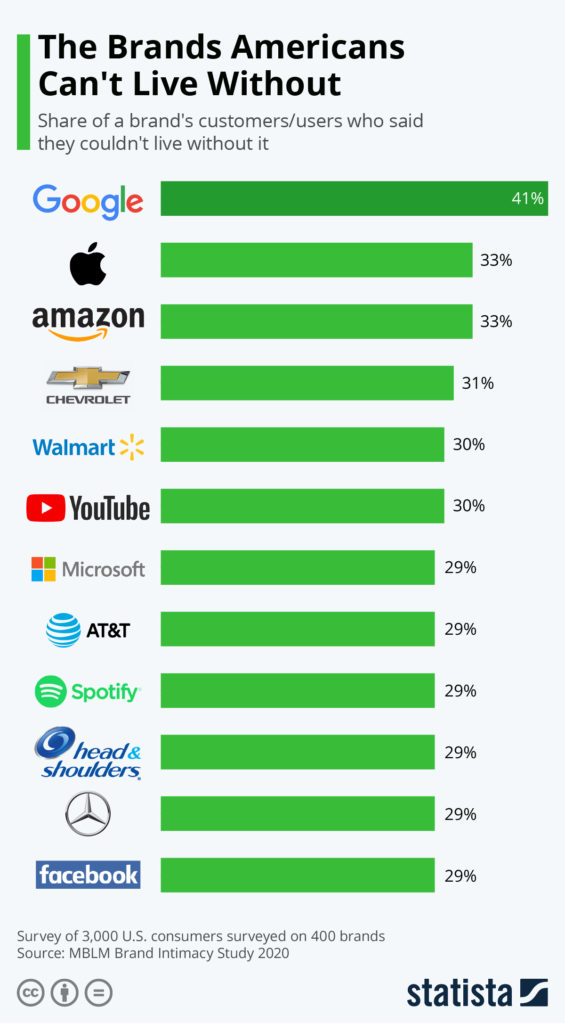

A study by marketing agency MBLM asked consumers what brands they could simply not live without.

Among the 10 biggest, Google was first as 41% of those surveyed said they could not live without the search engine giant. Apple Inc. (Nasdaq: APPL) and Amazon.com Inc. (Nasdaq: AMZN) were tied for second with 33%.

The study also found that YouTube continues to gain importance, jumping from No. 10 to No. 6. Coca-Cola Co. (NYSE: KO) dropped to No. 17 overall from No. 4 in 2019.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.