Recent record market gains could portend a banner year in 2020 plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Market Open

As of 10 a.m., U.S. markets were up across the board.

The Dow Jones Industrial Average was up 0.1% while the S&P 500 was also up 0.1%. The Nasdaq gains early were only 0.07% on early trading.

The Opening Bell

Do today’s stock gains foreshadow what 2020 has in store for the markets?

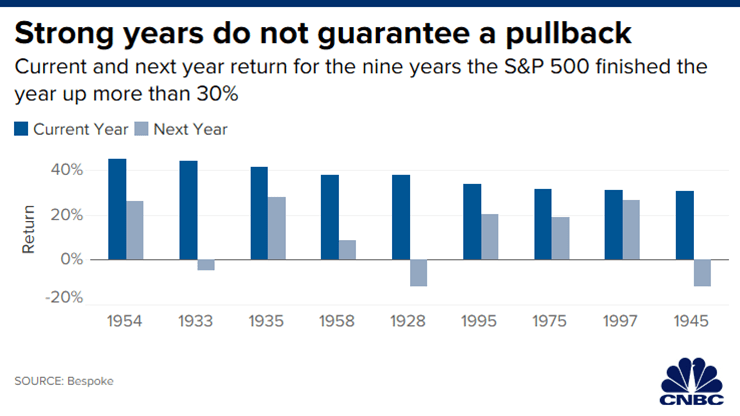

Research from Bespoke Investment Group shows the S&P 500 is up more than 27% so far in 2019 and CNBC suggests that it means more gains in 2020, but perhaps not quite as much.

According to Bespoke data, in every year the S&P 500 finished with gains of 30% or more, the market responded the following year with gains — but not as big — in all but three years: 1945, 1928 and 1933.

Stocks to Watch Today

Fiat Chrysler Automobiles NV (NYSE: FCAU) — Fiat Chrysler executives are meeting today with counterparts from PSA Groupe regarding the finalization of a $50 billion merger between the two companies. PSA Groupe is the parent company to Peugeot.

Navistar International Group (NYSE: NAV) — The school and commercial bus manufacturer will hold its quarterly earnings call this morning. Consensus estimates are at $0.96 per share and expectations are for an earnings beat, but a revenue loss.

Spark Therapeutics Inc. (Nasdaq: ONCE) — The Philadelphia-based gene therapy company jumped 0.8% on premarket trading as its acquisition by Swiss-based Roche Holdings AG is expected to be completed today. The Federal Trade Commission gave its thumbs-up to the deal Monday.

In the News

Following indication from the Federal Aviation Administration that its 737 Max will not fly in the immediate future, Boeing Co. (NYSE: BA) reported it will suspend production of the jetliner.

However, the company said it will not lay off the 12,000 workers at its Renton, Washington, facility.

The 737 Max has been grounded since March after crashes in Indonesia and Ethiopia killed more than 300 people.

Boeing stock was down 1% in premarket trading this morning.

Intel Acquires Israeli Chipmaker Habana Labs

Intel Corp. (Nasdaq: INTC) announced it is paying $2 billion for Israeli chipmaker Habana Labs. The move suggests Intel is getting serious about a move into the artificial intelligence space.

Habana Labs recently released its Goya chip with claims of a threefold performance advantage over Nvidia with lower latency, according to Forbes.

Intel Corp. shares dropped slightly in Monday afternoon trading.

Tesla Shares Rally On News of China Production

Shares of Tesla Inc. (Nasdaq: TSLA) jumped more than 6% Monday after photos were released of vehicles being produced at the company’s under-construction facility in Shanghai, China.

Monday was the largest gain for the automaker since it hit a record closing high of $385 in September 2017. Shares were as high as $383 in midday trading Monday, though, they were down 1% in premarket trading this morning.

Other Morning Reads

A Third of America’s Economy Is Concentrated in Just 31 Counties (Bloomberg)

Rickards Bullish on Stocks, Cash, Trump Reelection for 2020 (Money & Markets)

U.S. Lawmakers Negotiating Deal to Raise Tobacco Age to 21 (CNBC)

Earnings Reports

Here are the companies releasing earnings reports today:

Cintas Corp. (Nasdaq: CTAS)

FedEx Corp. (NYSE: FDX)

Navistar International Corp. (NYSE: NAV)

Jabil Inc. (NYSE: JBL)

Worthington Industries Inc. (NYSE: WOR)

Chart of the Day

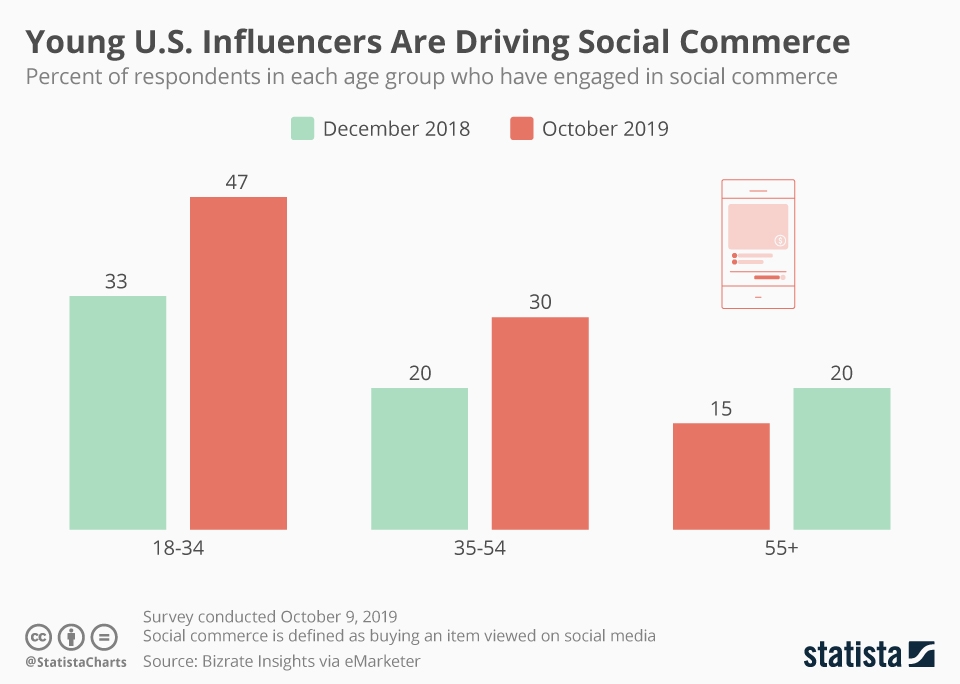

Social commerce is getting a ton of usage from social media users from 18 to 34 years old, according to a study from Bizrate Insights.

Nearly 47% of users in that demographic use platforms like Instagram and Snapchat. Social commerce use has also gone up for those ages 35 to 54 — from 20% to 30% — according to the study.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.