Despite a slowdown in the economy, the job market is stronger than normal.

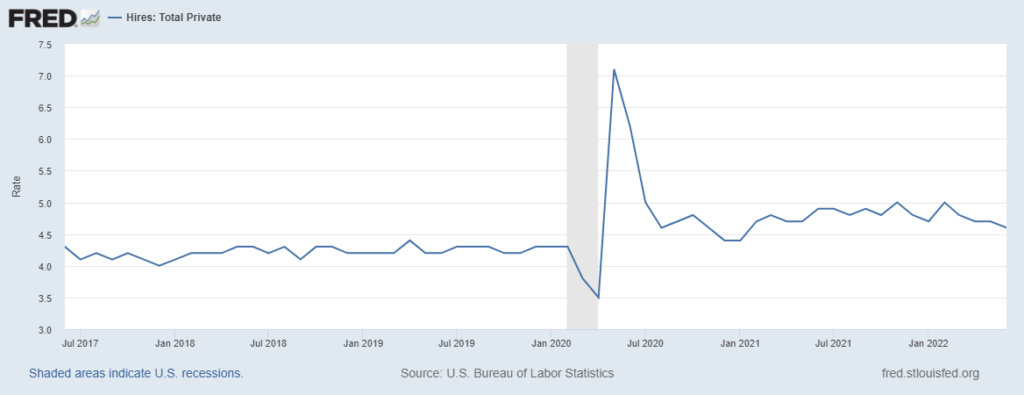

Data from the Labor Department’s Job Openings and Labor Turnover Survey shows how unusual the current labor market is.

Workers are quitting jobs at a surprising rate.

It’s clear employees believe their economic situation is strong.

In weak economies, few employees quit because they worry about finding a new job.

That’s not the case right now.

Unusual Yet Strong Job Market

Current data shows there are an estimated 10.7 million job openings.

This number remains high compared to the number of unemployed (5.7 million).

There were 1.8 job openings for each unemployed person in June.

For reference, the measure stood at around 1.2 openings per unemployed person before the current recession.

Before the 2008 recession, it was 0.6.

That means people quitting should have no trouble finding new jobs.

Companies are also hiring at a more significant rate than before the pandemic.

Significant Post-Pandemic Job Market Jump

Source: Federal Reserve.

This has turned the labor market upside down.

The Wall Street Journal notes:

Employers in many cases haven’t been able to find nearly enough employees following job cuts during the short, deep recession of early 2020. Others that have returned to pre-pandemic employment levels are hesitant to lay off workers, given the difficulty they have experienced rehiring after pandemic shutdowns. The unusual labor-market dynamic puts the U.S. economy in a stronger position to weather a downturn than in the past, according to some economists.

If growth slows amid rising prices and companies remain reluctant to reduce employment, they will struggle to find funds to invest in new opportunities if sales fall in the next recession.

That delays recovery and leads to weaker-than-average growth.

This is a recipe for stagflation, where inflation is high while the economy stagnates.

Job Market Forced Stagflation Before

We’ve seen this happen before in the previous instance of high inflation in the late 1970s.

Unemployment also increased as inflation ravaged the economy.

That could happen as companies cut employment due to weakening economic conditions.

Bottom line: It’s not a pretty picture.

But it’s one that investors need to navigate for the next few years.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.