Some of you have asked me about Subversive Capital Acquisition Corp. (OTC: SBVCF), a cannabis SPAC.

This company’s story has progressed in recent months, and I tell you all about it in the latest Marijuana Market Update.

Subversive Capital is a SPAC, or special purpose acquisition company.

The purpose of a SPAC is to merge with or acquire other companies.

If you own a private company, you can merge with a SPAC and go public right away, without the paperwork, underwriters and filing required for an IPO.

The founders of a SPAC typically target one or two companies for an acquisition, but they don’t tell anyone what those companies are when they form the SPAC.

A benefit to investors is limited risk, which I explain in detail in the Marijuana Market Update.

A drawback to most SPAC investing is that you have no idea what you’re buying.

The difference with Subversive Capital Acquisition is that investors know exactly what industry the SPAC is targeting: cannabis.

Subversive Capital Cannabis SPAC

Just last week, rap mogul Jay-Z — whose real name is Shawn Carter — joined Subversive as its new “Chief Visionary Officer.”

But there was more to it.

Subversive has joined with Caliva (a California cannabis company), Left Coast Ventures (a hemp manufacturer) and Carter’s entertainment company, Roc Nation, to form the largest cannabis SPAC in history:

The SPAC has received $36.5 million on a price of $10 per share.

Subversive’s primary goal here is to consolidate the well-established California cannabis market by investing in minority-owned cannabis companies as well as companies with large-scale cultivation and a history of strong distribution.

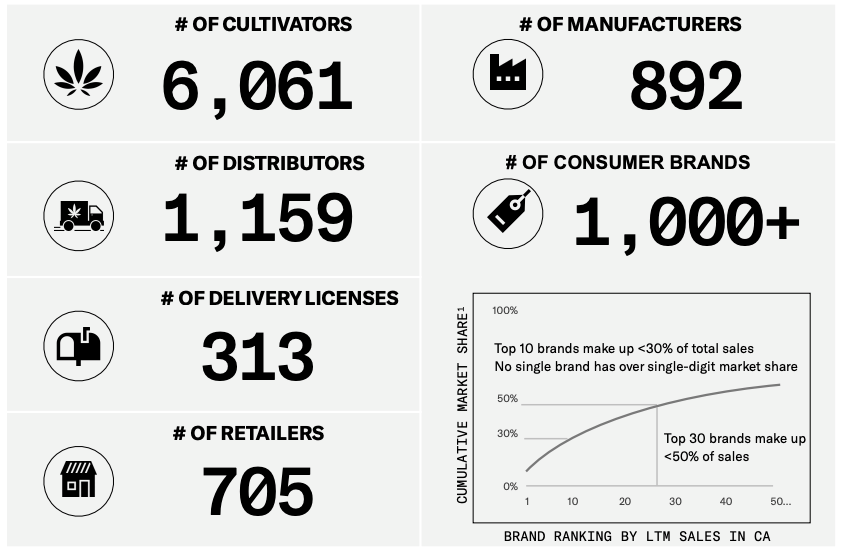

Because of its fragmentation today, the California market has no dominant cannabis company:

The company that can consolidate will gain market share — and has the potential to dominate the California cannabis market.

About SBVCF Stock

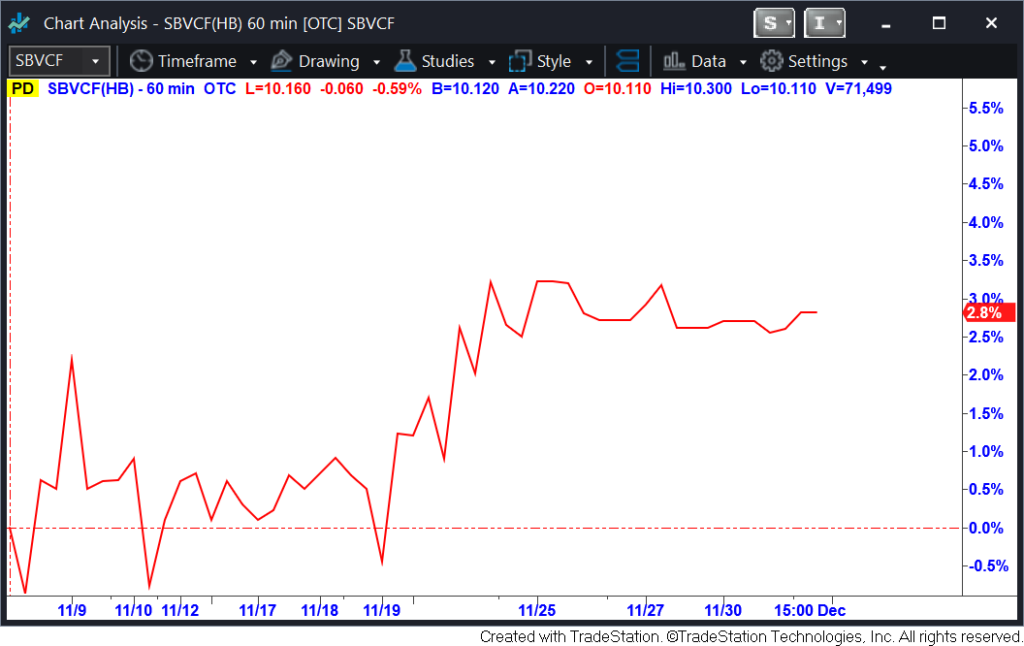

As for SBVCF stock, the company has seen some modest gains in the last two months since it launched.

To date, the SPAC has gained about 2.8%:

Watch the new Marijuana Market Update for the full story and upside and downside to investing in this cannabis SPAC.

Cannabis Watchlist Update

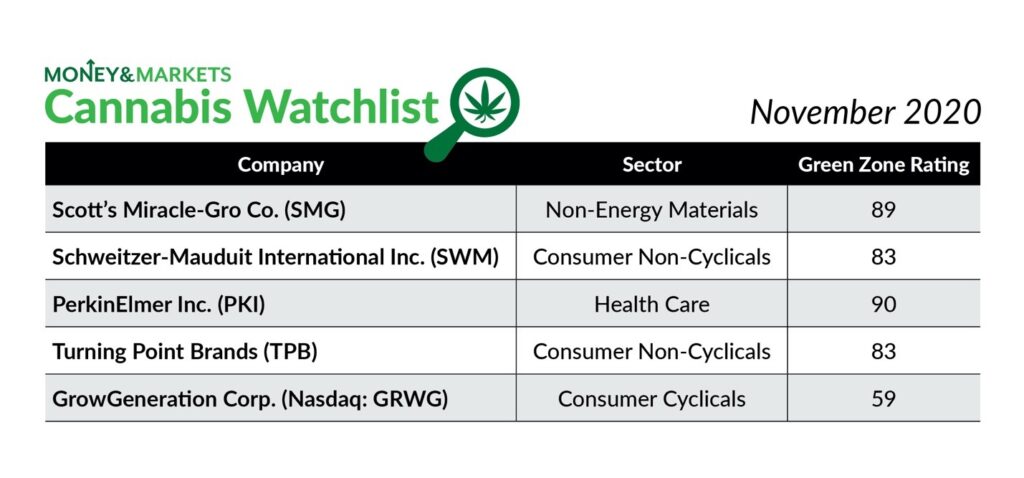

Now for an update on our Cannabis Watchlist.

The watchlist is on fire!

- Turning Point Brands (NYSE: TPB) is a traditional tobacco company that has started making products for the cannabis industry. So far, it has outperformed the rest of the cannabis industry and produced gains of more than 34% since I put it on the list.

- Schweitzer-Mauduit International Inc. (NYSE: SWM) is another tobacco company that has developed products for cannabis use. Since I put it on the watchlist in September, the company’s share price has jumped more than 16%.

- PerkinElmer Inc. (NYSE: PKI) tests various strains of cannabis for consumption. Since September, the company’s shares are up more than 16%.

- GrowGeneration Corp. (Nasdaq: GRWG) is a Denver, Colorado-based supply company that services the cannabis industry. It’s the most recent addition to the watchlist. I added it on November 17. Since then, it has not disappointed … climbing 28% since we added it.

Taking all the gains into consideration, the watchlist is up more than 19%.

Those gains blast past the broader market.

The iShares Core S&P 500 ETF (NYSE: IVV) is only up 3% since I put the first three cannabis stocks on our watchlist.

If you invested when I made those recommendations, congratulations on your gains!

By the way, I need to tell you about Chief Investment Strategist Adam O’Dell’s Millionaire Master Class, just in case you missed it.

Just go to www.theinvestingsecret.com to find out this trading secret Adam used to “retire” at age 33!

I use this very secret to guide the insight into the cannabis market that I share with you.

That’s about all from me this week.

As always, my team and I love the feedback we’re getting on our YouTube channel and through email.

Feel free to send comments, questions and stocks you want us to examine to feedback@moneyandmarkets.com — or leave a comment on YouTube!

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel, and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.