Despite suspended production in China and the U.S., Tesla shares soared as the company blew the doors off analysts’ projections for first-quarter deliveries.

Tesla Inc. (Nasdaq: TSLA) said on Thursday production and deliveries of its new Model Y sport utility vehicle was significantly ahead of schedule, as the company delivered its highest number of vehicles in any first quarter to date.

It’s the first quarter Tesla produced and delivered the Model Y.

The company, however, did not break down deliveries or production by model in its report.

Tesla shares were up over 6% around noon Friday after jumping 15% in premarket trading after the news broke.

What Happened in Q1 That Sent Tesla Shares Soaring?

Tesla reported delivering approximately 88,400 of its electric vehicles in Q1. Estimates were for around 79,900. Tesla also said it produced around 103,000 vehicles in total.

Banyan Hill’s Amber Lancaster

“Like many publicly traded companies, Tesla isn’t immune to COVID-19, but these delivery and production numbers show it produces solid products that are in demand,” Banyan Hill Publishing’s Amber Lancaster said.

Tesla only began to temporarily suspend production at its San Francisco Bay Area vehicle factory on March 24. It previously closed its Shanghai factory to help curb the spread of the coronavirus in China but has since re-opened it.

“Our delivery count should be viewed as slightly conservative, as we only count a car as delivered if it is transferred to the customer and all paperwork is correct,” the company said in a release. “Final numbers could vary by up to 0.5% or more.”

Tesla’s Q1 delivery news comes after the company reported an increase in its earnings per share to $2.14 a share from $2 a year ago.

What’s Next for Tesla Stock

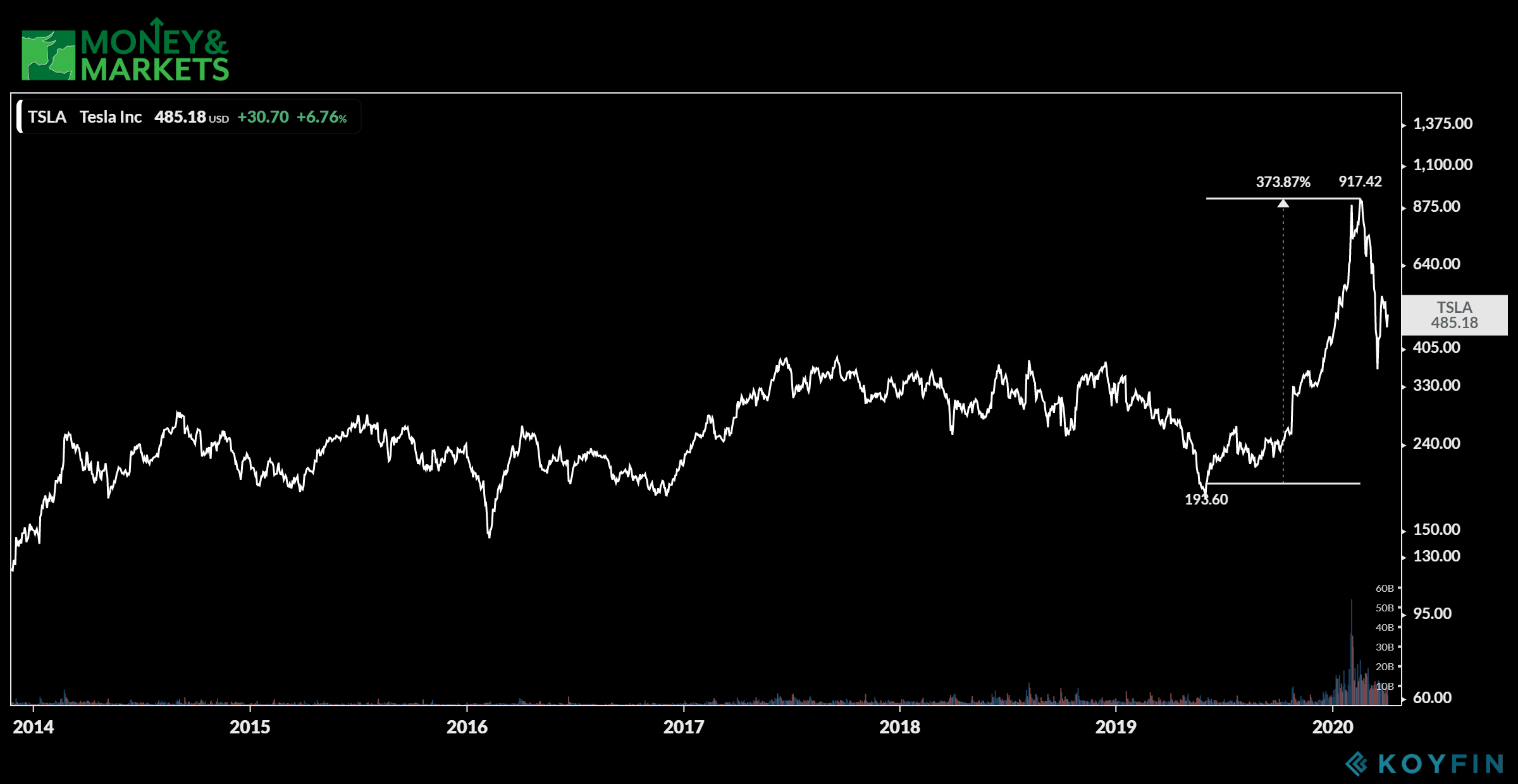

From May 2019 to the middle of February 2020, Tesla shares skyrocketed by more than 373%.

The broader market sell-off impacted the company as it pared back around half of those gains in a month.

Lancaster, Director of Investment Research for Bold Profits, which focuses on large-cap stocks with staying power and profitability, said she was still bullish on Tesla, but not because of the new Model Y release.

She said the addition of the Cybertruck will make a huge impact on Tesla’s bottom line.

“Most telling is that even during a pandemic the Cybertruck is receiving approximately 1,000 preorders per day,” Lancaster said.

The global electric vehicle market is projected to grow 22.3% to $567 billion by 2025.

That, coupled with Tesla’s diversification into more than just electric vehicle production, puts the company in line for potentially large profits.

“In all, Tesla is a diversified company with its eyes on the future. From batteries to solar, or tunnels to space, Tesla is a leader,” Lancaster said. “This COVID-19 crisis is accelerating technology change, and Telsa is a company that’s poised to lead the charge.”

Tesla is expected to report its Q1 earnings on April 22.