This year hasn’t been kind to many traditional high-dividend stocks.

Investors have flocked to the perceived safety of COVID-proof large-cap tech stocks.

They’ve cast aside most dividend payers, unloved.

Now, sometimes, a “cheap” stock is cheap for a reason.

This is certainly the case for many of the COVID-wrecked sectors, such as transportation and entertainment.

But other times, a cheap stock is one that a fickle market has overlooked while it was out chasing the next trend.

This brings me to my Dividend Stock of the Week: Verizon Communications (NYSE: VZ).

Verizon is one of the most reliable dividend payers in the S&P 500.

At current prices, it yields an attractive 4.22%.

It’s important to note that the dividend is safe. Verizon pays out a little more than half its profits as dividends.

And (perhaps just as important) Verizon is close to virus-proof.

It may see declines in business communications packages due to more people working from home. However, its consumer-oriented mobile, broadband and paid TV services have only become more important.

Consistent Growth Makes Verizon an Ideal Dividend Stock

Apart from a competitive yield, I like to see consistent dividend growth in an ideal dividend stock. And on that count, Verizon delivers.

The company has raised its dividend every year since 2007. Over the past 10 years, the average annual dividend growth has been just shy of 3%.

That’s not get-rich-quick money, but it has kept long-term Verizon investors ahead of inflation.

Verizon is a fantastic dividend-paying machine.

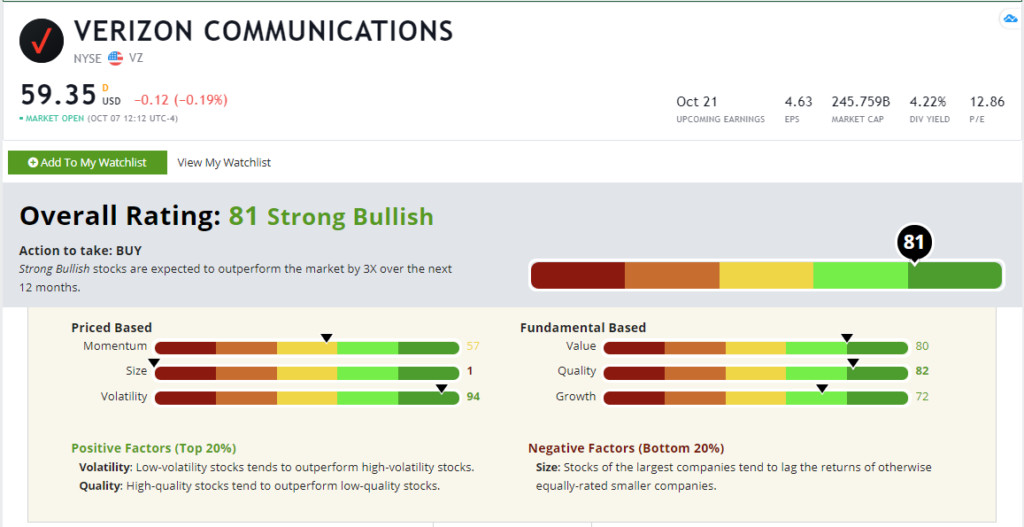

Bonus: Verizon rates “strong bullish” on Adam O’Dell’s Green Zone Ratings system, where it sports a composite rating of 81.

Verizon’s Green Zone Rating on October 7, 2020.

In our historical analysis, Strong Bullish stocks with ratings over 80 have outperformed the market by three times over the following 12 months.

Let’s take a look at what’s driving Verizon’s high ratings.

Verizon Stock’s Green Zone Rating

Volatility — It starts with Volatility … or rather, the lack of it. (Take a look at Adam’s recent piece on volatility for more about why this factor is so important.) Low-volatility stocks tend to outperform high-volatility stocks over the long run. Given the stable nature of Verizon’s businesses, it comes as no surprise that its volatility rating comes in at 94. This means that Verizon rates higher than all but 6% of stocks in our universe.

Quality — Verizon is also a high-quality stock, with a rating of 82. We measure Quality with a range of factors, but most tend to focus on profitability and debt management. While Verizon doesn’t enjoy the massive profit margins of a software company, it’s consistently profitable and enjoys a high return on equity of over 30%.

Value — Verizon is also a cheap stock, with a Value rating of 80. Value is a relative concept these days. By most metrics, the S&P 500 is the most expensive it’s been since the late-1990s internet bubble. But in an overall expensive market, Verizon is legitimately cheap. The stock trades for just 12 times earnings and, of course, sports a dividend yield north of 4%.

Growth — Perhaps surprisingly, Verizon rates highly in Growth as well, coming in at 72. I see plenty of high-Growth stocks that also rate highly in Quality. But it’s rare to find one that rates highly in Growth, Quality and Value. That’s getting close to mythical unicorn status.

Momentum — Stocks that have recently performed well tend to attract new investors, which creates a virtuous cycle. So, high-momentum stocks perform well. Verizon is in the middle of the pack here, rating a 57. This shouldn’t be surprising. Few stocks outside of tech or social media have exhibited truly great momentum this year.

Size — Smaller stocks have traditionally outperformed larger stocks. We won’t get much of a small-stock bounce from Verizon. The stock has a $244 billion market cap, and its Size rating is 1. So, 99% of the stocks in our universe out rate it here.

Takeaway: Verizon may not be an exciting stock, but it’s a solid dividend payer that rates Strong Bullish in our Green Zone rating system. So, apart from a reliable income stream, don’t be surprised if Verizon generates substantial market-beating returns over the next year.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.