Reverse engineering involves taking something apart to understand how it works. Usually, the engineers then make something that works like the original.

In the best case, getting back to where we were in January will take a year. That assumes we bottom within weeks. In reality, we are likely years away from full recovery.

Manufacturers might reverse engineer a competitor’s product to develop a lower-priced clone. That sounds like cheating. But some analysts believe China’s economy is booming because of reverse engineering electronics equipment and even pharmaceuticals.

But reverse engineering can be used in positive ways. Military planners have reverse engineered enemy equipment and tactics for centuries. Their goal is to develop countermeasures that blunt the effects of the enemy’s weapons.

Federal Reserve economists adopted the latter approach and reverse engineered the last recession. They used that knowledge to develop an indicator that measures the economy in real time.

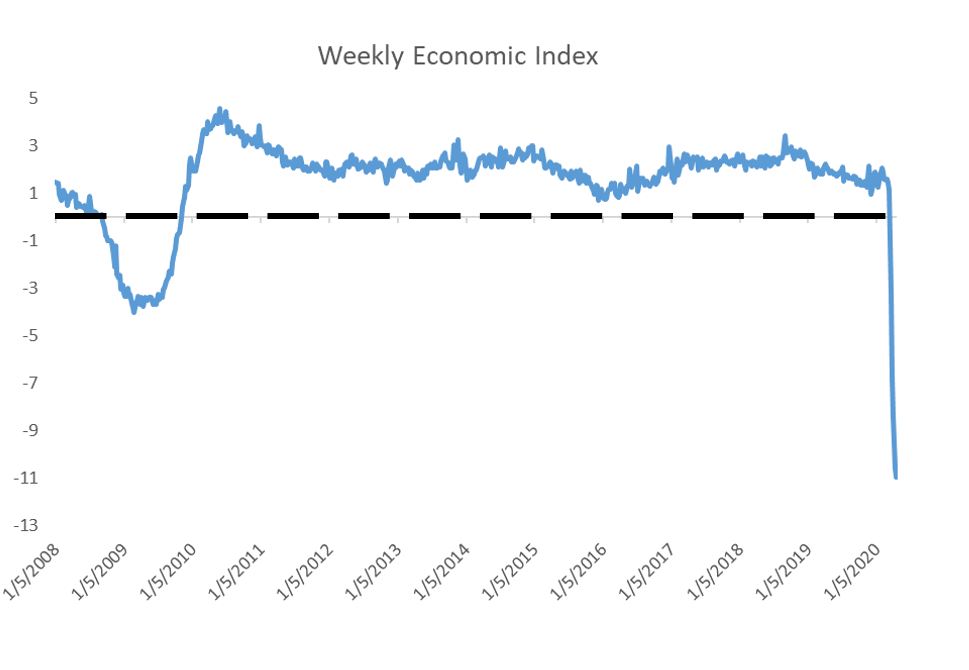

The Weekly Economic Index

The Fed’s Weekly Economic Index (WEI) is shown below. Based on current data, it forecasts a contraction of 10.95% in the economy.

Source: NY Federal Reserve

The Weekly Economic Index includes real-time data on retail sales, private data on hiring from staffing agencies, electricity production, fuel sales and railroad traffic among other inputs. It’s a comprehensive look at the economy from the consumer and producer perspectives.

At the bottom of the 2009 recession, the index showed the economy contracted 4%. The WEI bottomed in February 2009. The recession officially ended four months later. Unemployment peaked 10 months later. The economy reached its pre-recession peak in the second quarter of 2010.

Fed data confirms a recession is underway. That data also shows recoveries take time. After the bottom in 2009, growth remained sluggish for about six months.

Based on history, we should expect slow growth and high unemployment until at least this fall. The depth of this decline indicates it could take even longer to recover.

In the best case, getting back to where we were in January will take a year. That assumes we bottom within weeks.

In reality, we are likely years away from full recovery.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru