The Consumer Price Index number for October threw us a bone on Thursday!

The annualized inflation rate dropped to “only” 7.7% last month, which is still high by the standards of the past 40 years.

But it’s an improvement… And it was enough to send virtually everything higher. Stocks, bonds, gold … all were sharply higher on the news because maybe — just maybe! — it means the Federal Reserve is a little closer to easing its inflation fight.

Tech and growth-focused stocks rallied the hardest, as these tend to be the most sensitive to changes in interest rates.

We’ll see if this rally has legs.

What’s Next for Tech Stocks

It’s worth noting that we’re now in the most bullish seasonal time of year and that, historically, stocks have tended to do well after midterm elections.

But then, as my colleague Charles Sizemore has warned for months that the inverted yield curve is signaling a recession. So the indicators here are mixed.

My colleague Matt Clark wrote an excellent piece last week in which he drew several parallels between 2022’s sell-off in tech stocks and the great tech bust of 2000 to 2002.

I don’t do market forecasts. I don’t try to predict what the market will do. Instead, I follow trends and make trading decisions based on my proven, quantifiable factors.

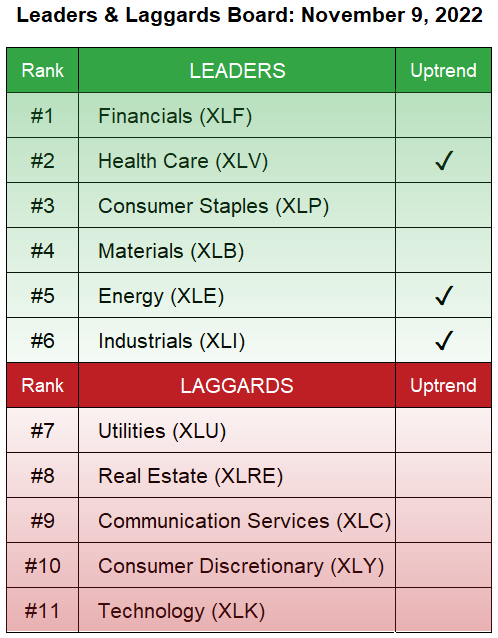

But it’s worth noting that the broader technology sector is not in a buy-qualified uptrend. You can see that in my Leaders & Laggards board below. (By the way, I give my Green Zone Fortunes subscribers this L&L board every week so they can know what sectors are trending higher or lower. My uptrend indicator on the right tells you what sectors are “buy-qualified.”)

That can change, but my models suggest that it’s best to stay away from the tech sector as a whole.

Why Energy Is the Place to Be

Here’s the thing. There’s always an opportunity somewhere. The beauty of my trading systems is that, because they incorporate momentum factors, they are built to adapt to the environment we’re in, rotating into the leaders and out of the laggards.

And about that…

When the bubble burst in tech stocks in the early 2000s, investors suddenly rediscovered energy and commodity stocks. It triggered a massive, multiyear bull market in those sectors. And my models have been pushing us to the energy sector for more than a year. You can see in my L&L board above that energy is one of only three sectors currently in a buy-qualified uptrend.

Our best-performing recommendation in Green Zone Fortunes is a small oil and gas exploration and production company, up almost 130% since I recommended it in March 2021. But my interest in energy goes beyond just traditional oil and gas.

I’ve been a believer in renewable energy for years, and it’s one of my highest-conviction mega trends.

This is also an area where technology and energy come together. Producing renewable energy via solar panels or windmills is easy. But developing optimal storage and distribution is complex … and thus fertile ground for innovative new companies in the space.

And naturally, apart from the technological aspects of green energy, there’s the raw materials that go into the storage systems. I made a major new investment in this space in August, and we’re already up over 26%.

This month, I’ve found yet another energy sector opportunity, but I’ve gone in a different direction. It’s neither traditional oil and gas, nor is it renewable green energy.

But it is an established energy source with decades of real-world use. Following the Russian invasion of Ukraine, it’s now taken on a whole new level of importance.

In the November issue of Green Zone Fortunes, I recommend a company that has all but secured a monopoly in the United States on the fuel needed to make this power source work. To find out more click here and see why I see so much opportunity in the renewable energy space.

If you join me in Green Zone Fortunes today, you’ll gain access to a model portfolio full of different ways to invest in energy. And you’ll see how my convictions lie with companies that are using technology to innovate and bring renewable energy to the forefront.

You’ll also be one of the first to receive my latest Green Zone Fortunes recommendation when I send it out to readers later this week. So click here and see how you can join now.

To good profits,

Adam O’Dell

Chief Investment Strategist