Many analysts are pointing to cash on the sideline as a reason to buy stocks. They argue that trillions of dollars are going to move into the stock market, and that will push prices up.

For now, look for cash to build up no matter what stock prices do.

It’s certainly true that there are trillions of dollars in cash on the sidelines. Much of it is in money market funds, earning very little if any interest.

Barron’s reported on the growing piles of cash.

“According to Morningstar data, money market funds drew $388 billion in April and $31 billion in May, pushing the total amount parked in the funds to a record $4.8 trillion, surpassing the January 2009 peak of $3.8 trillion.”

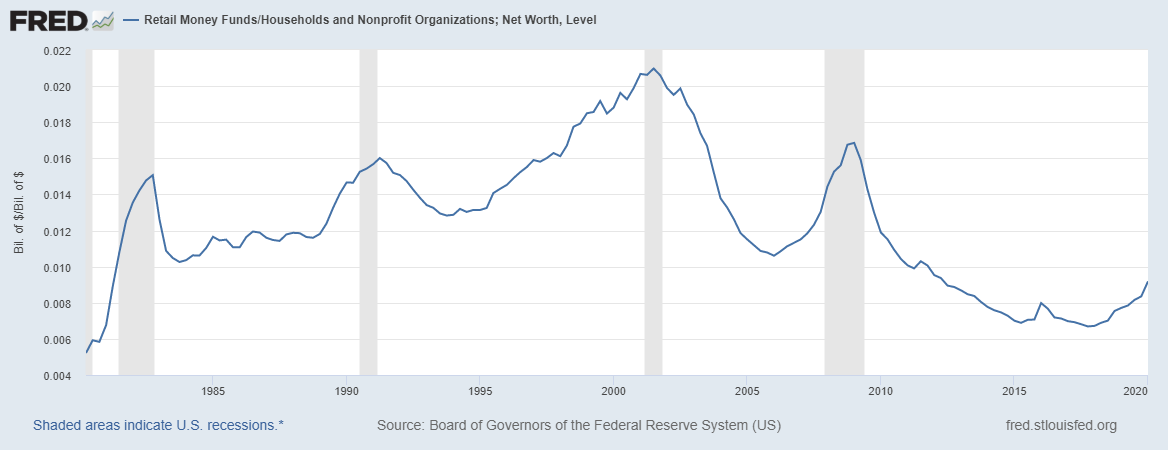

From another perspective, the chart below shows that cash is actually close to historic lows. This is a more realistic perspective than simply counting dollars in money market funds.

Source: Federal Reserve

This chart uses data from the Federal Reserve to show the percentage of cash in money market funds relative to total wealth. There are some trends in the data.

Cash rises in recessions, which are shown as grey bars on the chart. As the economy recovers, cash levels drop. That makes sense since individuals should hold more cash when uncertainty is high.

Uncertainty explains the increase in cash holdings throughout the 1990s. That was an economic expansion that coincided with increased unemployment as companies reduced layers of management.

That was also a bull market that unfolded as there was a record amount of cash on the sidelines then as well. That decade alone undermines the bulls’ current argument.

The recent small increase in cash holdings relative to wealth began before the bear market. That makes sense because economic woes were building even before the economy was shut down.

This shows there is always a need to place random facts in the news into historical context.

There are trillions of dollars in money market funds. But that’s not necessarily bullish.

Uncertainty is high and will remain high for some time. Individuals should hold more cash in uncertain times.

For now, look for cash to build up no matter what stock prices do.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.