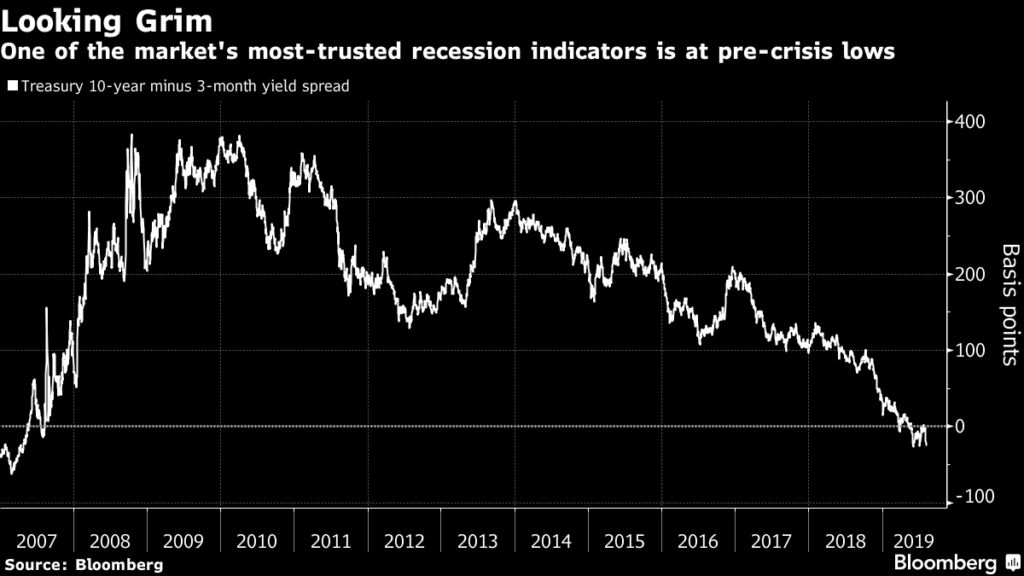

As markets took a beating on Monday, one closely watched recession indicator in the Treasury market blared its loudest warning since 2007.

The yield curve inverted to its widest gap since before the 2008 financial crisis when rates on 10-year notes plummeted to 1.71% as investors fled from stocks amid the market’s worst day of 2019. The gap between the 10-year and three-month notes, the two factors that create the inverted yield curve, widened to 32 basis points, according to Bloomberg.

An inversion has happened a couple of times this year, including once in May when the market was also going through a rough patch that was also influenced by the trade war between the U.S. and China.

The trade war, once again, prompted the market sell-off Monday as China reacted to President Donald Trump’s newest tariff threat by allowing the yuan, China’s currency, to fall to politically sensitive levels while also halting imports of U.S. agricultural goods, like soybeans. A number of major investors predict the 10-year yields to continue sliding as an end to the prolonged trade dispute seems murky, at best.

Rick Rieder, global chief investment officer of fixed income at Count BlackRock Inc., predicts the 10-year note will drop to 1.5%.

“We could be in a significantly lower-rate environment for a while,” Rieder told Bloomberg Television on Monday.

Columbia Threadneedle’s Ed Al-Hussainy sees the 10-year dragging as well, but he believes interest rate cuts by the Federal Reserve could help reverse the yield’s course.

“Potentially now the curve starts to steepen because the Fed is being pressured — by a combination of data and obviously downside risks in trade — to be more forceful,” Al-Hussainy told Bloomberg in a phone interview.

The market is already pricing in another interest rate cut in September after buying heavily into Fed funds futures contracts following the central bank’s recent rate cut of 0.25%. Al-Hussainy expects more aggressive market positioning is coming, and the signal from the yield curve shows a higher probability of the Fed’s policy rate hitting zero within a year, according to Bloomberg.

“There’s a huge disconnect now,” he said. “You don’t need to do a lot of mental gymnastics to get to the Fed having to cut 200 basis points to put off a recession.”