It’s not often that you see a company worth nearly $100 billion jump 41% in a single day.

But that’s exactly what happened to Zoom Video Communications Inc. (Nasdaq: ZM) on September 1. Following a much better than expected earnings report, Zoom finished the day up 41%.

The pop represented an increase of $37 billion in market capitalization. That’s roughly the equivalent of the entire Chipotle Mexican Grill (NYSE: CMG) company.

That’s a huge move. But it proved unsustainable as the stock has lost more than 20% since then amid a broader tech stock sell-off.

Zoom has been a fixture in the post-COVID world. It’s become the online meeting app of choice for businesses and schools. It’s even become the go-to for online happy hours and birthday parties. My children even have soccer classes via Zoom with teachers in South America.

Zoom has allowed us to muddle through with some semblance of normalcy in a truly unusual year.

There are plenty of competitors, including Skype, Microsoft Teams, Cisco Webex and Google Hangouts. But Zoom is the global default.

That said, a good product doesn’t always make a good stock.

Let’s take an analytical, unbiased look at Zoom’s stock rating using Adam O’Dell’s Green Zone Ratings system.

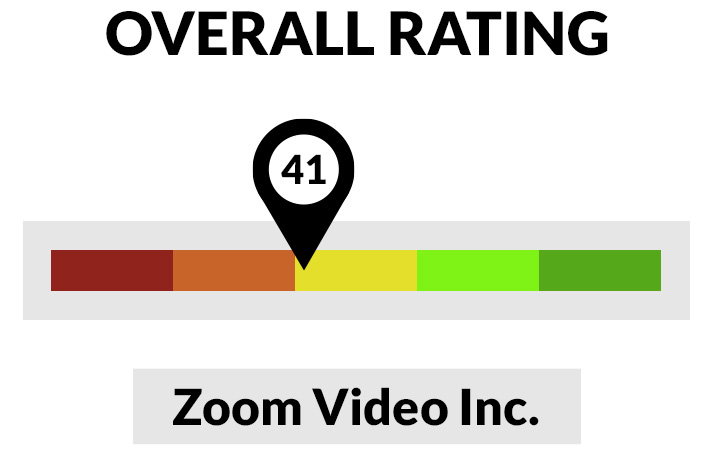

Zoom Stock Rating

Right off the bat, you can see that Zoom’s high-flying stock looks overextended. Its overall score is an uninspiring 41. That means that 59% of stocks in our universe rate higher.

Here’s a closer look at Zoom’s stock rating.

Growth — Zoom rates well on growth, scoring an 88. Zoom’s blistering growth rate is more than a COVID-19 story. Since 2017, Zoom has doubled or come close to doubling its revenues every single year. The pandemic helped Zoom. But the company was on a nice growth trajectory long before “coronavirus” because a household word.

Quality — Zoom is a high-quality stock, scoring an 81. Much of this is linked to Zoom’s low debt profile and its asset-lite structure. Software companies often rate high in quality. Zoom is no exception.

Momentum — Perhaps surprisingly, Zoom boasts a modest momentum rating of 60. Momentum is more than just recent performance, though trailing returns account for about a third of the score. There are also volume and trend metrics that are included in the calculations. Zoom finds itself very much in the middle of the pack.

Volatility — Volatility is a negative. We want stocks that are less volatile, and a high rating in this category means exactly that. Zoom rates a 51 in volatility. Price swings up and down are going to be more common. This last week is a perfect example.

Value — Zoom’s stock rating is dragged down by its value, rating a 3. This means that fully 97% of stocks in our universe represent a better value. Tech stocks will often trade at a premium to the broader market, which is normal. You pay up for growth and quality. But Zoom is an expensive stock even by tech standards.

Size — Smaller companies tend to outperform larger ones over time. Well, Zoom will be getting no bump based on size. It actually rates a 0 as its market cap has soared over $100 billion.

Takeaway: Zoom’s stock has a lot of momentum, and it’s entirely possible that carries on for several more months. We’re in a bubble market, and anything can happen.

But if you’re looking to initiate a new long-term position, you should think twice. Based on our historical backtesting, stocks rated in Zoom’s range tend to perform no better than the broader market over time.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.