It’s long been viewed as a safe haven to protect investors against market downturns, so Money and Markets is sharing our three gold stocks to buy now.

When markets are down, one of the biggest things investors turn to are safe-haven assets. Gold has become one of the most prominent of those assets, with bonds being another.

The gold market skyrocketed to new highs as equities retreated on fears of the coronavirus spread.

So it’s time to share our three gold stocks to buy now.

1. Franco Nevada Corp.

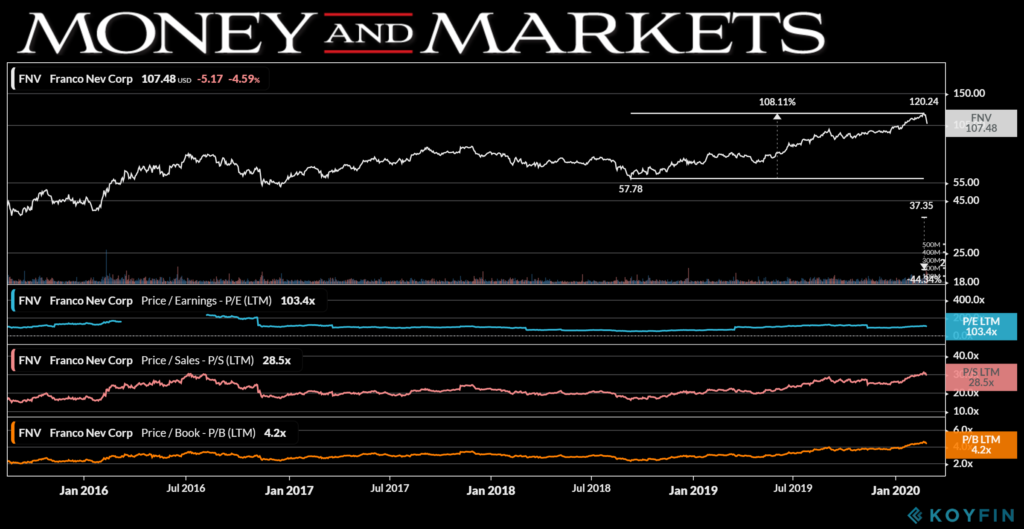

Market Capitalization: $21 billion.

5-Year Return: 130.7%.

Annual Dividend Yield: 0.85%.

Franco Nevada Corp. (NYSE: FNV) focuses on gold royalty and streams. They don’t own mines or do any exploration. Instead, they own royalties on gold, which limits exposure to capital, operating and other costs.

Based in Toronto, Ontario, Canada, Franco Nevada has been one of the best gold stocks for investors in terms of returns. In the last five years, the company has a return of 130.7%.

Despite a recent market drop overall, Franco Nevada is still trading well above its 200-day moving average. It’s also below its 52-week high of $119.31, and it comes with a nice dividend for investors. Its current dividend yield is 0.85% and its last dividend payment was $0.25 per share.

The company’s consistent growth, as well as its dividend to investors, makes Franco Nevada one of our three gold stocks to buy now.

2. Barrick Gold Corp.

Market Capitalization: $35 billion.

5-Year Return: 74.43%.

Annual Dividend Yield: 0.95%.

Another Canadian company, Barrick Gold Corp. (NYSE: GOLD) is one of the largest producers of international gold. It has mines in North and South America.

Of the top 10 top in the world, Barrick owns half of them.

Its all-in sustaining cost remains relatively low, meaning even if gold prices dip, Barrick shares won’t likely match that drop.

Barrick has done well for investors in the last five years. Over that time, its return is more than 74%.

Its share value is also in a good spot, trading at a price-to-earnings multiple of 8.8 and a price-to-sales ratio of 3.6. Since the end of May 2019, shares of Barrick have risen more than 85%.

The company does pay a dividend, albeit relatively small. Its annual dividend yield is 0.95% and its last dividend payment was only $0.07 per share. However, that dividend has been as high as $2.67 per share.

Its position in the market, however, makes Barrick Gold Corp. one of our three gold stocks to buy now.

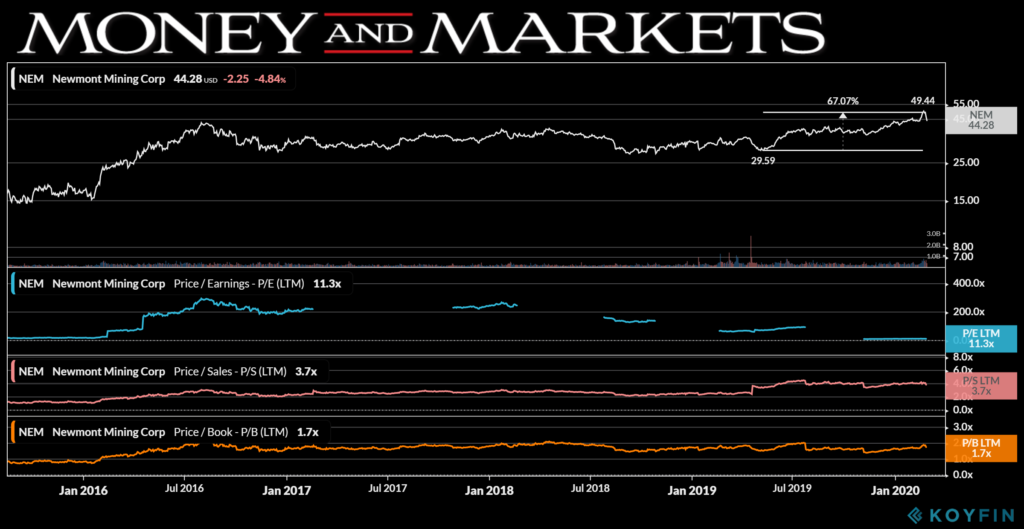

3. Newmont Mining Corp.

Market Capitalization: $37 billion.

5-Year Return: 99.7%.

Annual Dividend Yield: 1.13%.

The largest company by market capitalization on our list is Newmont Mining Corp. (NYSE: NEM) at $37 billion.

Based outside Denver, Colorado, Newmont is a gold company but also produces silver, copper, zinc and lead. It has operations in North and South America, Australia and Africa.

But the real story is the company’s earnings per share. In the last year, its annual earnings per share jumped 495.3%. For the last quarter of 2019, that growth was 10,200%. That means Newmont’s business is growing and that additional revenue can go back to shareholders or be reinvested.

Newmont’s share price rose more than 67% since May 2019 and its valuation is in good shape. Its price-to-earnings ratio is 11.3 while its price-to-sales is 3.7.

On top of solid technical analysis, Newmont is another company that pays a dividend to shareholders every quarter. Its annual dividend yield is 1.13% and its last dividend payment was $0.14 per share. That’s been a steady dividend rate for more than two years.

Its prospect for growth and strong earnings make Newmont Mining Corp. one of our three gold stocks to buy now.

From mining to royalties to gold, there are many different ways to invest in gold. It’s not just about buying gold bars or coins and storing them in a warehouse.

These companies provide solid growth potential along with dividend payments to investors.

That’s why they are our three gold stocks to buy now.

Related:

3 Cheap 5G Stocks to Buy Right Now

6 5G Dividend Stocks to Buy Now

4 Cloud Software Stocks to Buy Now

4 Semiconductor Stocks to Buy Now

5 5G ETFs to Buy Now

7 5G Stocks to Buy Right Now

4 Stocks to Buy and Hold for 2020

3 Dividend Stocks to Buy in 2020

5 ETFs to Buy in 2020

5 Tech Stocks to Buy in 2020