Everything had been going swimmingly on the stock market until the coronavirus scare and one economist sees a slowdown on the horizon, making gold the place to take shelter.

“I’m not bullish. Valuations are at extreme levels and the level of complacency is also a red flag.”

David Rosenberg, chief economist at Rosenberg Research and Associates, thinks some kind of slowdown will hit the U.S. economy in 2020 despite lowered trade tensions between the U.S. and China, and the bull market that continues to break record after record.

“If things are so great, why did the Fed have to cut rates last year?” Rosenberg said in a recent interview with Bloomberg. “If things are so great, why did the Fed have to embark on QE4, that we’re not supposed to call QE4?”

QE4 refers to a fourth run of quantitative easing, which is a way for central banks like the Federal Reserve to pump new money into the market through things like government bond purchases.

Rosenberg calls the current boom in the U.S. market a “bull market in financial engineering,” fueled by the Fed’s three rate cuts in 2019 and its recent attempts to stabilize repo markets through Treasury purchases (QE). President Donald Trump’s tax cuts in 2017 resulted in a $32 billion windfall for America’s top banks, and corporate buybacks helped as well.

“This is a liquidity-driven market. Liquidity is your best friend on Monday and your worst coward on Friday,” Rosenberg said.

“Last year was like, just throw a dart. Right now, it’s indiscriminate buying. Investing isn’t supposed to be like that. Investing isn’t supposed to be easy.”

And Rosenberg doesn’t think the markets are going to be sustainable throughout 2020.

“At this level, many things have to go optimally so that the prices are higher at the end of the year,” Rosenberg said in an interview with German website, The Market/NZZ.

“I’m not bullish. Valuations are at extreme levels and the level of complacency is also a red flag. There are needles in the haystack, but this overall market rally is more a house of straw than a house of brick.”

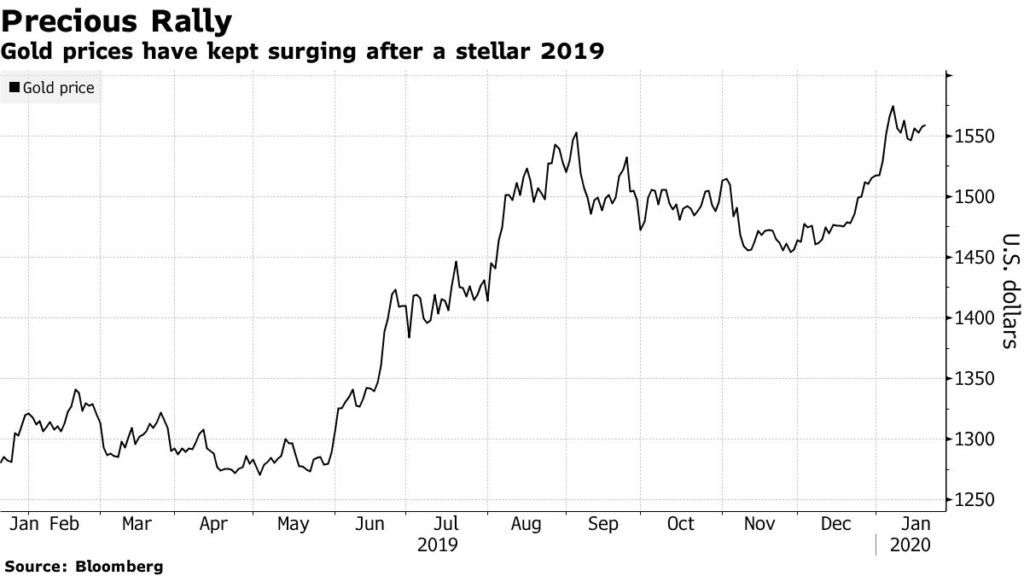

All that leads to gold being the place investors want to be, according to Rosenberg.

“Gold is a place you want to be,” Rosenberg said. “I think that it’s partly because its inversely correlated with interest rates. But it’s also an insurance policy when things go wrong. There’s no such thing as a no-brainer, but this is close.”

Bridgewater Associates CIO Greg Jensen also sees gold hitting $3,000 in the future, and the U.S. dollar is going to lose its status as the world’s reserve currency.

“When you look at the geopolitical strife, how many foreign entities really want to hold dollars?” Jensen asked in a recent interview. “And what are they going to hold? Gold stands out.”

So far, gold has sustained levels between $1,560 and $1,570 an ounce to start off the year and were up to $1,582 this morning, but Rosenberg sees the precious metal hitting $3,000 in the future.

“It’s just a matter of when, not if. Gold demand is predicated on the final act, which is going to be right-out debt monetization,” Rosenberg told The Market/NZZ.

“When we get to the lows of the next recession, we’re going to find that these Central Banks that already have been extremely aggressive are going to engage in what is otherwise known as the ‘debt jubilee’ or a right-out debt monetization, which was actually the final chapter of the Bernanke playbook. Remember, Ben Bernanke got his nickname ‘Helicopter Ben’ because in a speech in 2002 he suggested that helicopter money could always be used to prevent deflation. So we’re going to have helicopter money.”