I’m doing something a little different.

Usually on Tuesday, I give you some analysis of a stock from our weekly hotlist.

Pro tip: If you aren’t familiar with our weekly hotlist, click here to find out more. You can gain free access to this valuable feature today!

I’m always on the lookout for great stocks that rate highly on chief investment strategist Adam O’Dell’s six-factor Green Zone Ratings system.

I use that system, along with some other research, to generate our weekly hotlist.

And I’ve been writing about these high-rated stocks for almost a year.

So, I thought it was time to look back on some of the stocks I’ve told you about that turned into real winners.

And Adam’s Green Zone Ratings system made them a lot easier to find. Click here to see how you can use our free ratings system to find more top stocks today.

Here are three stocks that have produced triple-digit gains since I told you about them.

Green Zone Ratings Stock No. 1: Aviat Networks Rides A Wave Higher

On July 15, 2020 I wrote about a company that manufactures and sells wireless networking products, including those that support new 5G network expansion.

Aviat Networks Inc. (Nasdaq: AVNW) scored a 99 overall on Green Zone Ratings system at the time — making it one of the highest-rated stocks on our list at the time.

Its stock price bounced nicely following the March 2020 COVID-19 crash.

During the crash, Aviat’s stock price dropped nearly 45%.

Aviat Gains 236% Since July 15, 2020

As you can see, the stock caught fire after the crash and went from trading around $10 per share to $42 just last month.

It lost some ground later in April 2021, but it is pushing its way back up.

Note: Aviat currently scores a 95 in Green Zone Ratings, meaning our system is still “Strong Bullish” on it almost one year later.

To date, Aviat Networks has gained 236% since I told you about it in July!

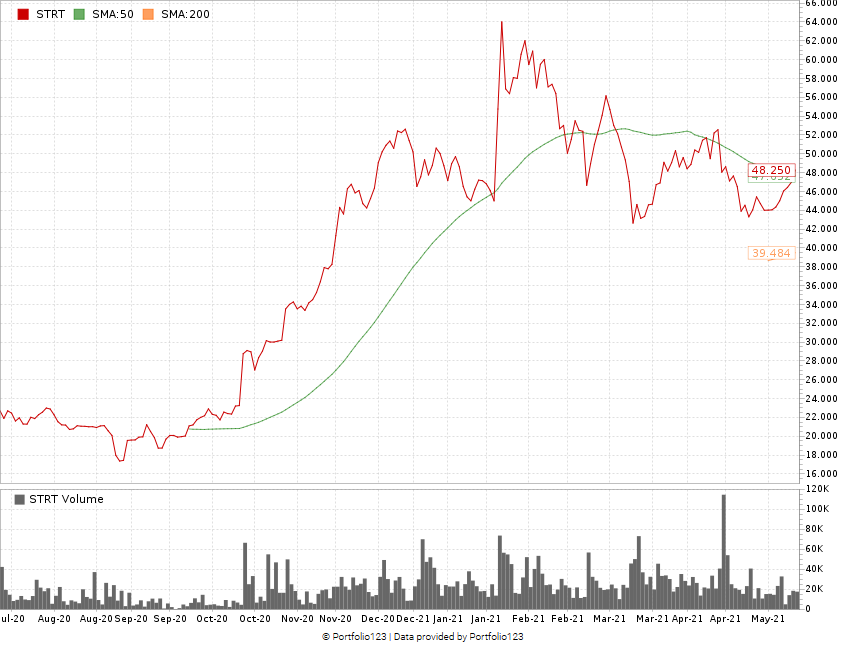

Green Zone Ratings Stock No. 2: Strattec Security Corp. Builds Momentum on Auto Industry

The COVID-19 pandemic hit the automotive industry hard.

Vehicles weren’t selling as people stayed at home amid lockdown measures.

But that didn’t last.

On July 27, 2020, I told you about a company that develops and manufactures automatic door and ignition locks for automotive producers.

At the time, Strattec Security Corp. (Nasdaq: STRT) was struggling along with other automotive suppliers because orders for cars and trucks were down.

It rated a 96 overall on our Green Zone Ratings system.

Strattec Gains As Auto Industry Picks Up

It lived up to our expectations, gaining 112% since the day I told you about it.

Strattec’s stock jumped as high as $64 per share from around $22 in August.

The stock price scaled back during the tech sell-off, but it’s finding momentum higher.

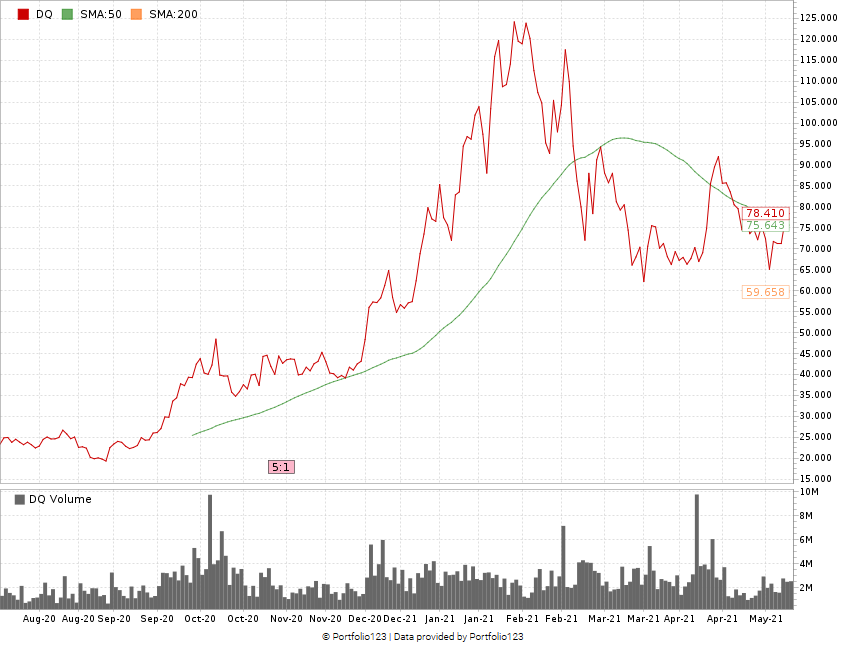

Stock No. 3: Daqo New Energy Capitalizes on Chinese Renewables

A week after writing about Strattec, our Green Zone Ratings system revealed another great stock.

Daqo New Energy Corp. (NYSE: DQ) is a Chinese firm that manufactures and sells polysilicon used in solar panels.

Daqo scored a 93 at the time. And it is in a prime position to capitalize on the renewable energy boom in China.

Daqo Up 232% Since August 2020

Much like Aviat, Daqo got a big bounce in late 2020. Its stock price went from around $10 to $40 and reached as high as $125.

And, like Aviat and Strattec, it pared some of those gains during the tech sell-off in March, but it is starting to push higher and remains above its 50-day moving average.

It’s currently 236% higher than its price when I wrote about it in August 2020.

Bottom line: Using our Green Zone Ratings system is a great start to find winners like these.

And I mentioned just a few. Here are some other top performers I have reported on:

- Ameresco Inc. (NYSE: AMRC) — Up 84% since July 9, 2020.

- Albermarle Corp. (NYSE: ALB) — Up 81% since July 22, 2020.

- United Micro Electronics (NYSE: UMC) — Up 63% since Nov. 3, 2020.

- Matson Inc. (NYSE: MATX) — Up 62% since Sept. 9, 2020.

And don’t forget about Collectors Universe Inc. (Nasdaq: CLCT) — a company that provides grading and authentication for collectibles!

The company was sold a few months after I wrote about it back in July 2020.

From the time I told you about it to the time it sold, the stock gained nearly 140%!

More recently, I wrote about Century Communities Inc. (NYSE: CCS) to capitalize on the housing boom.

Since April 27, the stock has risen nearly 16% … that’s in less than a month!

It’s fun to brag a little about some of the stocks we’ve reported on, but that wasn’t the true intention of this article. I wanted to show you how Green Zone Ratings helped me find these market-crushing stocks. And I won’t stop using it to find you new stock winners in the future.

In fact, I’ll be back soon with another Green Zone Ratings frontrunner that you can invest in before it soars higher.

If you aren’t familiar with our system, I encourage you to watch this short video explaining how it works. I walk you through finding big winners in the stock market:

I encourage you to use our Green Zone Ratings system when looking for your next investment. Or just keep turning to Money & Markets where I, along with the rest of the team, will keep finding top stocks for you to invest in.

You won’t be disappointed.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.