Presidential elections offer data-driven investors a unique opportunity to assess which sectors of the economy are likely to outperform under the incoming administration.

Since the election happens on a discrete date, and since investors know the winning administration will be in place for the next four years, the immediate reaction of stock market sectors to the result can be quite telling.

Interestingly, despite all the talk of Joe Biden wanting to kill off the traditionally “dirty” oil and gas industry, energy-sector stocks are up 51% since November 6 … more than any other broad stock sector.

The broad financial sector, which has gained an impressive 26% in the past two months, is the runner-up.

Looking at these sectors’ subset industry group ETFs, the three top-performers since election day have been:

- SPDR Oil & Gas Equipment (XES), up 88%.

- SPDR Oil & Gas Exploration (XOP), up 74%.

- SPDR Regional Banks (KRE), up 43%.

For comparison’s sake, the tech-heavy Nasdaq 100 darling (QQQ) is up only 7% in the same time.

Of course, data-driven investors like ourselves know better than to look at one data point in isolation.

There’s a big difference between the starting points of the energy and financial sectors. Energy stocks have enjoyed a post-election rally only after suffering one of their worst declines in modern history. The sector was down more than 70% from its 2014 highs when Biden won!

Meanwhile, the financial sector has held up just fine in recent years. It was down only 20% from its 2020 highs on election day.

What’s more, while the oil and gas industry groups are still 50%-plus off their respective highs, the SPDR Regional Banks ETF (NYSE: KRE) is now hitting new 52-week highs alongside its recent bullish rally.

In my Home Run Profits service, we’re holding momentum-driven plays on each of these three industry groups via either diversified ETFs or single-stock plays. And so far, they’re all handing us impressive profits … including our regional bank stock, which is up well over 100% now.

Today, I’m sharing an “ETF X-ray” of the SPDR Regional Banks ETF (NYSE: KRE).

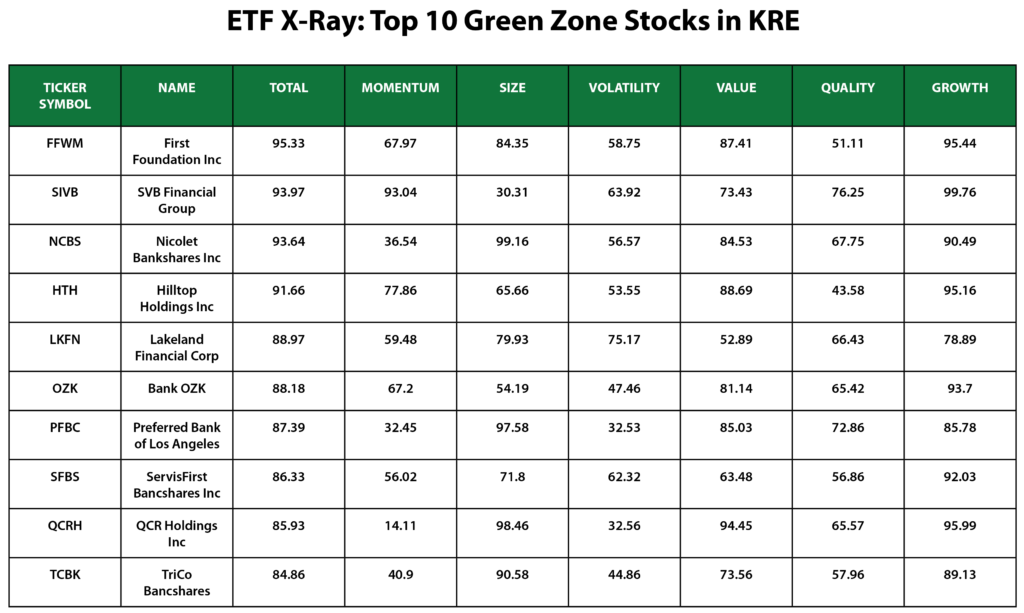

We’ll use my six-factor Green Zone Ratings model to rank the individual stock holdings within the fund, identifying its top 10 stocks … all of which earn a “strong bullish” rating of 85 or above.

ETF X-Ray: KRE’s Impressive Growth Factor

The total number of individual stock holdings in the SPDR Regional Banks ETF (NYSE: KRE) earn an average overall Green Zone rating of 56.

Of the six factors the system ranks on, the ETF’s growth score is the highest, at 77, followed by its value score of 67. Finally, regional banks tend to be smaller companies. We see this in the ETF’s above-average size score of 60.

Ultimately, while buying shares of this diversified regional bank ETF will give you broad-based exposure to the industry group, a quick “ETF X-ray” reveals a number of individual stocks that are rated quite highly … suggesting you have the opportunity to earn market-beating returns by selecting top-rated stocks within the group.

Here’s a table showing the Top-10 rated stocks, based on their overall six-factor score:

Buying any one of these regional bank stocks within KRE could set you up nicely for market-beating returns ahead. They all sport overall scores of 80 or above — a rating that historically has led to returns three times greater than the overall market.

In full disclosure, my Home Run Profits readers aren’t holding the top-ranked stock in this list. We made a bullish play on Bank OZK (Nasdaq: OZK) in late November.

You see, in Home Run Profits, I use the Green Zone Ratings model to hone in on “well-rounded” and top-rated stocks. But I then also use my time-tested momentum system to find the right time to buy these top-rated stocks.

That’s why I recommended my readers buy into Bank OZK. Shortly after election day, not only was the stock top-rated based on my Green Zone Ratings model … but my momentum-convergence system was giving me a screaming “buy now” signal.

My Home Run Profits readers have already locked in a gain of over 100% on this play, but I still think the stock has a long way to run before losing steam.

And like I said, you’ll likely do well in any of the top-rated regional bank stocks highlighted in my ETF x-ray of the SPDR Regional Bank ETF (NYSE: KRE).

Investors have made it clear since Election Day that this industry group is a winner under the incoming Biden administration.

I recommend adding some bullish exposure to regional banks today, either with a diversified position in KRE or one of its top-rated Green Zone stocks.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets

P.S. It’s too late to get into our Home Run Profits trade on OZK — but my system just gave me a brand-new trade signal yesterday morning.

I want to see how things play out over the next few days before I recommend it to my readers. But I’ve got a feeling about this one — just like the other five positions my Home Run Profits community is sitting on right now. All five are in the green.

To learn how to be ready for this next potential winner, go here now. I expect to send out my alert on Tuesday, but it could be sooner. I’d hate for you to miss out.