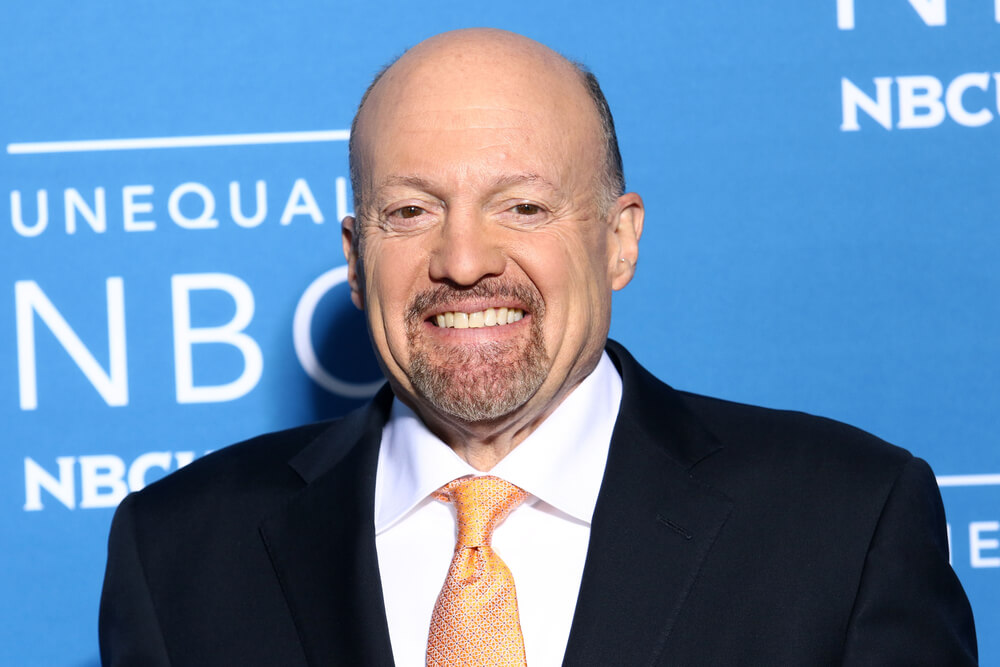

Following seemingly endless market euphoria, stocks took a hit Monday after more cases of the deadly coronavirus were confirmed over the weekend. But CNBC’s Jim Cramer doesn’t think it’s time to buy quite yet.

“This is the panic people have been waiting for,” Cramer said during an interview on CNBC’s “Squawk on the Street” after Wall Street experienced its worst selloff in months Monday morning.

“We’ve been saying over and over if we get an exogenous event that’s when you get the sell off, that’s when you have to buy,” Cramer said. “I think it’s only timing when (investors) have to buy. … Give it a little break.”

When looking for a good gauge of the stock market’s future, Cramer said to look no further than Apple, which could show if investors are in the buying mood. Even after the downturn Monday morning, Apple shares are still up around 5.5% in 2020, and that’s after they rallied almost 90% last year.

“I always said own it, don’t trade it,” Cramer said of Apple stock. “Why not wait now if you don’t own it?”

Apple, which touts a market cap of almost $1.4 trillion and is America’s most valuable company, is expected to report its quarterly earnings after the closing bell Tuesday. FactSet is projecting its fiscal first quarter revenue to be around $88 billion with earnings of $4.54 per share.

While some investors may be in the buying mood, Cramer thinks there could be a “second leg” drop if the World Health Organization declares the deadly coronavirus a global emergency. It’s why Cramer thinks investors should wait a little longer before really jumping in.

The new strain of the coronavirus now has over 2,900 confirmed cases and at least 81 deaths in China. Twelve other countries, including the U.S., which has five confirmed cases as of Sunday, have reported cases.

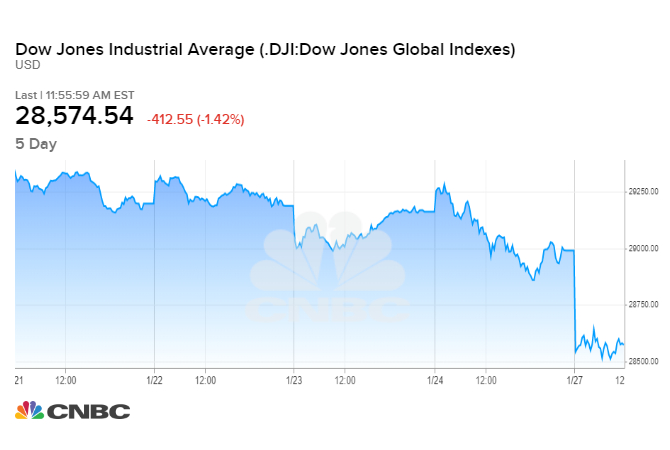

The Dow Jones Industrial Average index fell more than 450 points Monday. The Nasdaq, which is comprised of many tech companies, also lost 1.8%. Futures on Tuesday morning had recovered a bit with the Dow up 137 points around 8:30 a.m. on the East Coast, and the S&P 500 recovering 0.6% while the Nasdaq had recovered 0.8% around the same time.