It seems almost naïve today, but in 2017 I believed that the bitcoin bubble was a sign that risk appetites were out of control and that the broader bull market in stocks was close to ending.

The bitcoin bubble would burst, dampening animal spirits, and other risky assets like stocks would be next.

Well, three years later, the animal spirits are still alive and well. Yes, the COVID-19 scare ended the great bull market in stocks that started in 2009. But stocks have bounced back. And it’s debatable whether the longer-term secular bull market ever ended.

As for bitcoin, I can’t say this is Bitcoin Bubble 2.0 … at least not yet.

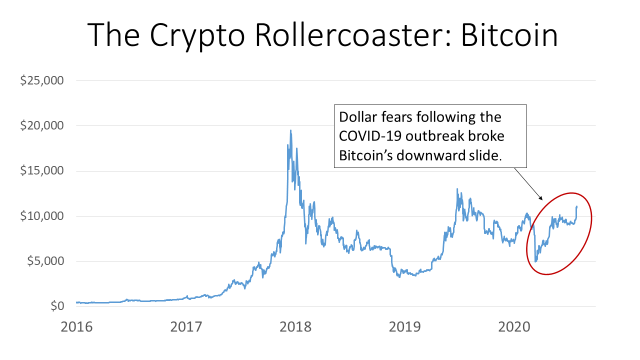

In 2017, bitcoin rose by over 1,000% from its low to its high. But then, the bubble burst, and the price sank throughout 2018. Bitcoin rallied for the first half of 2019 … then rolled over and died again.

When the virus lockdowns went into effect, Bitcoin reversed course and has been trending higher ever since. The cryptocurrency is up about 120% from March lows.

What’s Inflating the Bitcoin Bubble?

I’ve been writing about gold lately, noting last week that the barbarous relic has further to run after hitting new all-time highs.

Well, the arguments for gold and bitcoin are similar.

- Both are perceived to be valuable due to their rarity. The amount of gold in the Earth’s crust is fixed, and the expense of digging it out naturally keeps supply growth in check. Bitcoin’s supply is regulated by a complex algorithm.

- And both are insulated from Federal Reserve tinkering. The Fed can print dollars with reckless abandon, but it can’t make gold or bitcoin materialize out of the ether.

If you’re wondering why bitcoin is soaring, that’s it. Investors are worried about the long-term health of the dollar and of paper currencies in general. The Fed has increased its balance sheet by $3 trillion, and It shows no signs of slowing down.

We’re not going back to the gold standard any time soon. I don’t think we’ll ever go back to a commodity-based currency. The transition would be too painful and too deflationary.

We’re also not likely to see a cryptocurrency-based monetary system any time soon. Crypto is still in its infancy. And crypto networks lack the bandwidth to handle the volumes needed.

Furthermore, gold and bitcoin are both flawed as currencies. Neither is practical for day-to-day spending, and the transaction costs are steep. Even if we have a proper currency crisis, you’d still need U.S. dollars to function in the real world.

But here’s the thing. While we still need dollars as a medium of exchange and a unit of measure, we need them far less as a store of value. And that is where gold and crypto come into play. I don’t see investor skepticism toward the dollar subsiding as long as we’re running multi-trillion-dollar budget deficits, and the Fed hoovers up every bond it can find.

I’m not suggesting you run out and dump your dollars. I’m certainly not dumping mine. But I am hedging my bets by keeping at least a sliver of my savings in anti-currencies.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and co-host on our podcast, The Bull & The Bear. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.