You may not have “big investor money” and think you can’t play the game, but Money & Markets is here with some penny stocks to buy in 2020.

It’s a highly volatile market to trade in, but penny stocks can turn a relatively small investment into a large gain. Those gains can be erased just as quickly, too.

Most penny stocks trade over the counter, making them very susceptible to losing money. But by looking for penny stocks traded on more regulated exchanges, you might find some diamonds in the rough.

Finding those kinds of companies takes painstaking time and research, so we’ve done the work for you.

What Are Penny Stocks?

They are just what they say. They are stocks trading for pennies rather than dollars. Some may trade for just a few dollars, but nothing more.

A good investing strategy is to just dip your toe in the proverbial penny stock waters. Since most penny stocks lose money, you should only invest what you are willing to lose and no more.

Don’t expect to get rich anytime soon trading in penny stocks, but they are a very inexpensive way to learn the ins and outs stock trading.

Also, don’t let your emotions get in the way of trading. You may want to look for the hippest industry to trade penny stocks, but that could turn out to be a bad move. Do your homework and use things like this list as a guide.

With that being said, lets take a look at the penny stocks to buy in 2020.

Penny Stocks to Buy in 2020

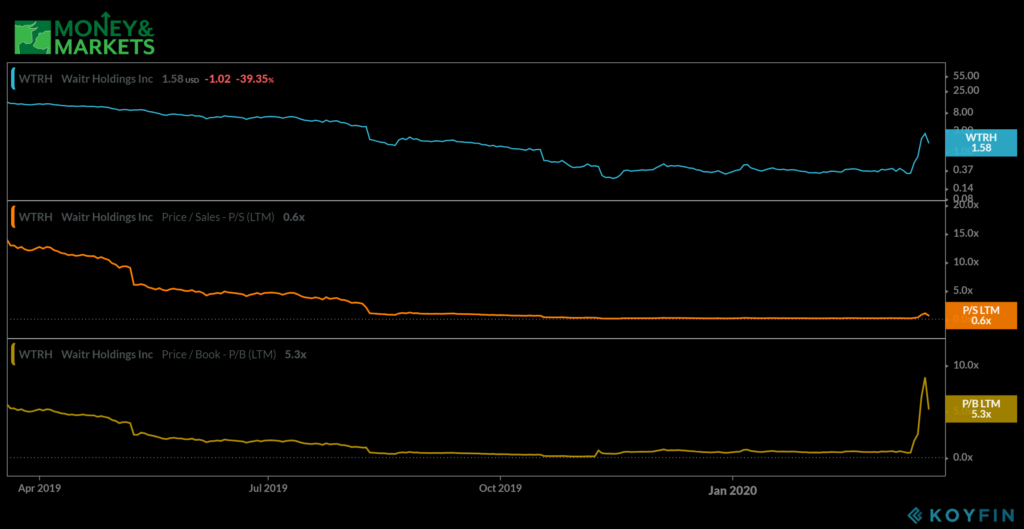

1. Waitr Holdings Inc.

Market Capitalization: $58 million

Annual Sales (2019): $69 million

5-Year Earnings Growth: 0.0%

As more and more Americans are forced to stay home due to the outbreak of the coronavirus, or COVID-19, it’s likely they will still want to eat out.

Enter Waitr Holdings Inc. (Nasdaq: WTRH).

This company specializes in online food ordering and delivery. The Louisiana-based company works with national food chains to provide this service.

While a small fish in a big food delivery pond, Waitr shares have seen a 322% bounce amid the overall bear market conditions hitting equities.

It trades with a price to sales of 0.6 and a price to book of 5.3. It’s still trading well below its 52-week high of $14.24. That means, at some point, investors felt Waitr was a solid company in get into.

But it has solid upside and has been able to hold up amid market pressure. That’s why Waitr Holdings Inc. is one of the penny stocks to buy in 2020.

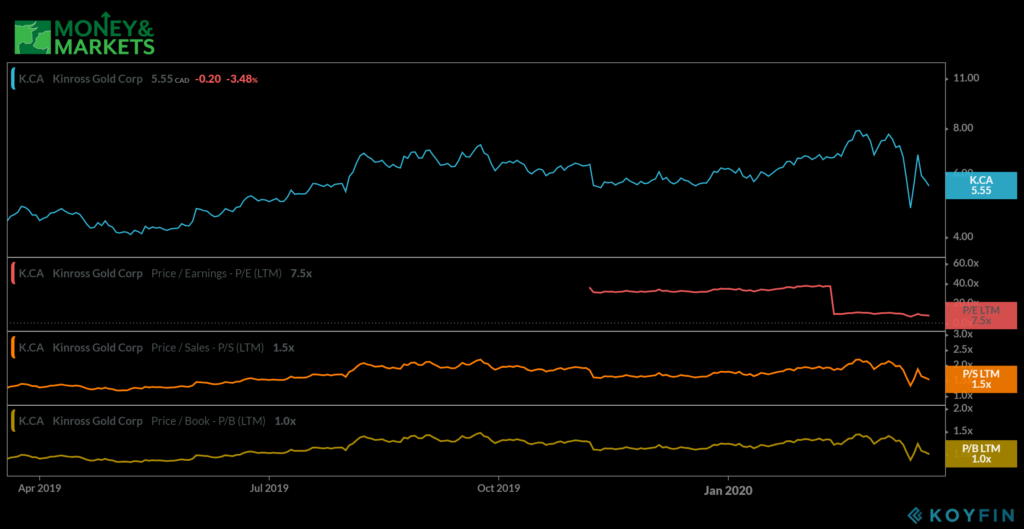

2. Kinross Gold Corp.

Market Capitalization: $6 billion

Annual Sales (2019): $3 million

5-Year Earnings Growth: 209%

As equities markets continue to slide, investors often turn to safe havens to protect their investments. One of those safe havens is gold.

Kinross Gold Corp. (NYSE: KGC) is a gold stock that lives in the penny stock world.

Kinross operates gold mines in South America, North America, West Africa and Russia. It has the largest market capitalization of any company on our list, by far — nearly $6 billion. It’s also one of the highest-priced penny stocks, trading at around $4 per share.

As the market fell into bear market territory, Kinross was able to bounce nearly 35% off its low of $3.47 per share.

Even when the markets were trading strong, Kinross maintained value by trading relatively flat. Its current price to earnings is 7.5 while its price to sales is 1.5 and its price to book is 1.

It may be a little more expensive to invest in Kinross if you are looking for penny stocks, but its ability to hold value makes Kinross Gold Corp. one of the penny stocks in buy in 2020.

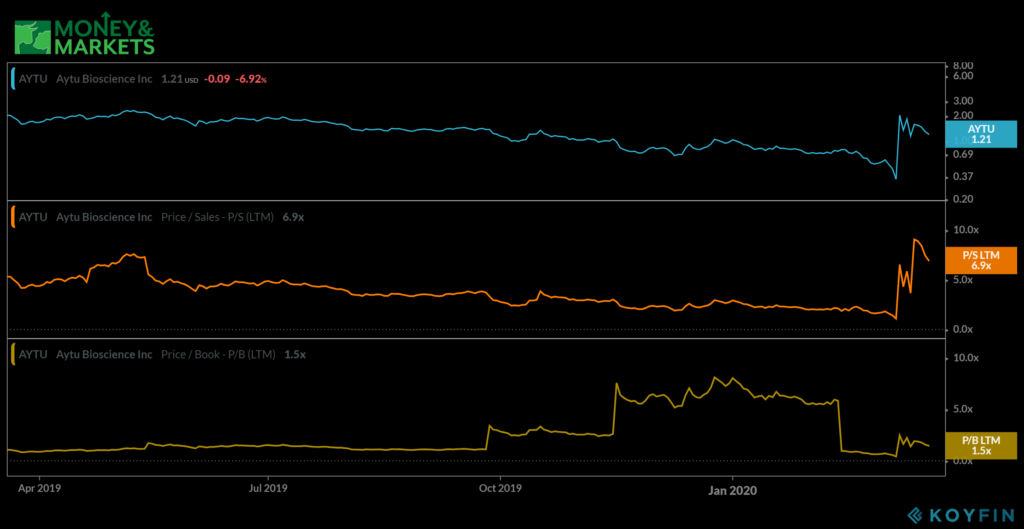

3. Aytu Bioscience Inc.

Market Capitalization: $43 million

Annual sales (2019): $7 million

5-Year Earnings Growth: 0.0%

While focusing on urology medical products, Aytu Bioscience Inc. (Nasdaq: AYTU) has branched off to capitalize on the coronavirus.

It recently announced it was accelerating the availability of a coronavirus test in the U.S.

Prior to that, Aytu Bioscience made products addressing prostate cancer, urinary tract infections and male infertility.

After just a slight drop in share price in March, Aytu Bioscience shares hit a 418% jump. It has pared some of those gains back, but not by a whole lot.

Its current price to sales is 6.9 and its price to book is 1.5, so there is room for Aytu to grow further, especially as the need for coronavirus tests remains strong.

That is a big reason why Aytu Bioscience Inc. is one of the penny stocks to buy in 2020.

Penny stock companies can range from food service to bioscience and everything in between.

But again, you need to exercise caution if you are interested in investing in these companies. As we said before, the penny stock market is highly volatile and these share prices can move up or down rapidly and without cause.

What we have provided is meant to be a guide, so tread with caution and track these penny stocks to buy in 2020.

Editor’s Note: Looking for stocks to buy not on our list? Let us know in the comments below.

Related

- 4 Artificial Intelligence ETFs to Buy Now

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020