Thanks to a massive increase in spending by the Pentagon, companies making weapons for the military stand to continue generating solid profits for investors, so here’s a look at three defense stocks to buy in 2020.

When global tensions rise — and they seemingly always do — one way to make solid gains is by owning defense market stocks.

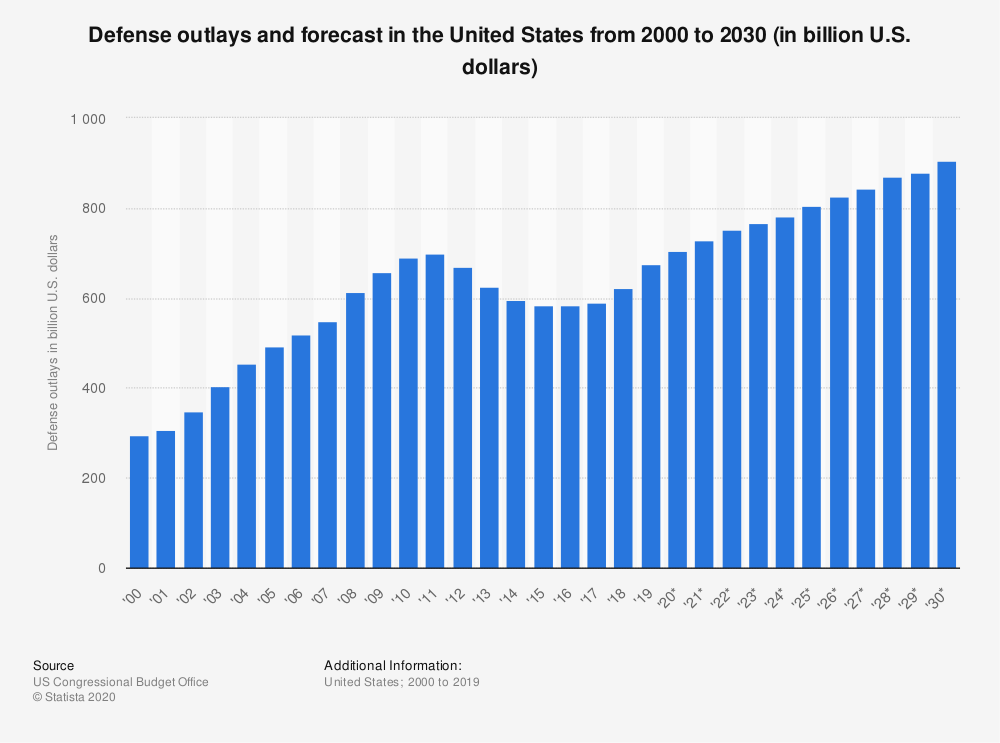

Even if there isn’t global conflict, the fact that defense spending in the U.S. alone is expected to jump from $676 billion in 2019 to $906 billion in 2030, defense companies will be reaping the rewards.

Others who will celebrate are investors who found the right defense companies to buy into before the jump.

So here are the three defense stocks to buy in 2020.

3 Defense Stocks to Buy in 2020

1. Lockheed Martin Corp.

Market Capitalization: $87 billion

Annual Sales (2019): $59 billion

Annual Dividend Yield: 3.08%

As the biggest defense company in the field, Lockheed Martin Corp. (NYSE: LMT) is one of the most consistent.

In 2019, sales for the company were around $59 billion.

The biggest winner for Lockheed Martin is its F-35 Joint Strike Fighter. The single-seat, single-engine jet is operational in all three branches of the U.S military.

The jet costs around $94 million for the lower-end version and Lockheed Martin is expected to rake in more than $1 trillion in various revenue over the fighter’s 55-year life span.

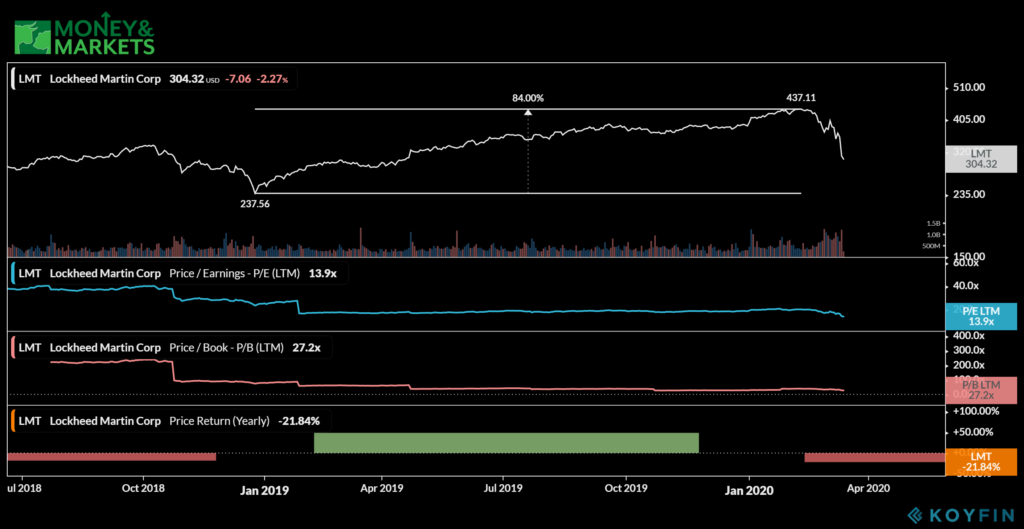

As for its share price, since the end of 2018 until the recent bear market dip, Lockheed Martin’s share price has skyrocketed by 84%.

The February 2020 sell-off pushed Lockheed Martin down to around $300 per share. That just means its growth potential is strong once the dip recedes.

Another strong point of the company is its dividend yield. Currently, Lockheed Martin’s yield is 3.08% and its February 2020 dividend payment was $2.40 per share to shareholders.

That is what makes Lockheed Martin one of three defense stocks to buy in 2020.

2. Raytheon Co.

Market Capitalization: $40 billion

Annual Sales (2019): $29 billion

Annual Dividend Yield: 2.62%

The maker of the popular Patriot missile system and the Aegis air defense system is Raytheon Co. (NYSE: RTN).

The company raked in $29 billion in sales in 2019, thanks in large part to the Patriot missile as it is the primary air and missile defense system for the U.S. Army. The Army is in the midst of upgrading the fire-control computers, communications and radar systems for the Patriot.

But a big selling point for Raytheon is its pending merger with United Technologies. Together, the $100 million deal will create a company with nearly $77 billion in annual revenue.

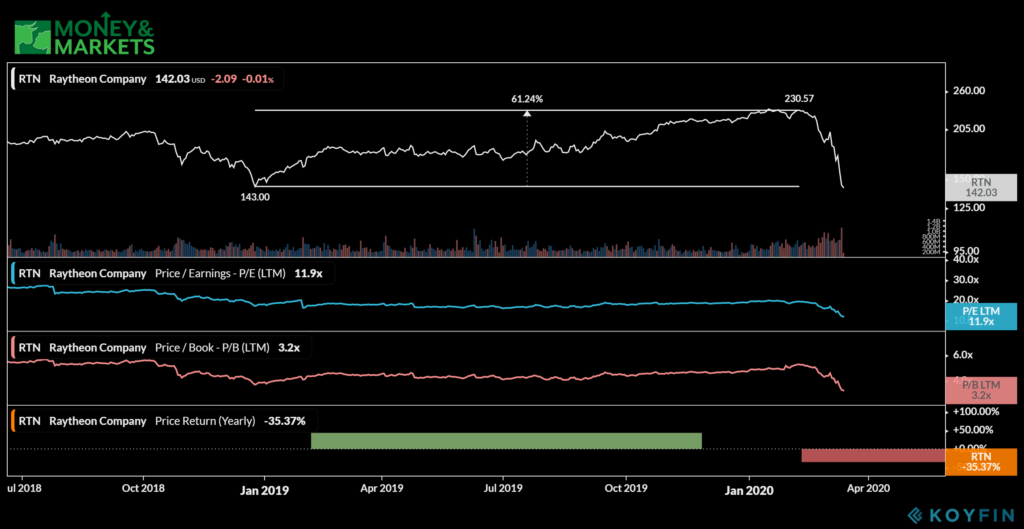

Since 2018, Raytheon shares have consistently risen, to the tune of a 61% increase through January 2020. Like Lockheed Martin, the company did suffer from the market downturn in February and March.

However, low price to earnings and price to book make Raytheon a bargain for investors.

The company also pays a dividend — although not as high as Lockheed Martin. Its most recent annual dividend yield was 2.62% and its January 2020 dividend payment was $0.94 per share.

The biggest reason why Raytheon is on our list of the three defense stocks to buy in 2020 is because of what the company will become once its merger with United becomes complete.

3. Northrup Grumman Corp.

Market Capitalization: $48 billion

Annual Sales (2019): $33 billion

Annual Dividend Yield: 1.82%

If there is a company set to cash in on military spending in the immediate future, it’s Northrup Grumman Corp. (NYSE: NOC).

The U.S. Air Force could buy as many as 100 of Northrup’s new B-21 stealth bomber, generating nearly $80 billion in new revenue for the company (the actual price of the bomber is still a secret). The Air Force will use the new bomber to replace its B-1 and B-2 bomber fleet.

That represents a massive sales boom for Northrup Grumman over the next several years. Additionally, the company is one of the primary subcontractors for Lockheed Martin.

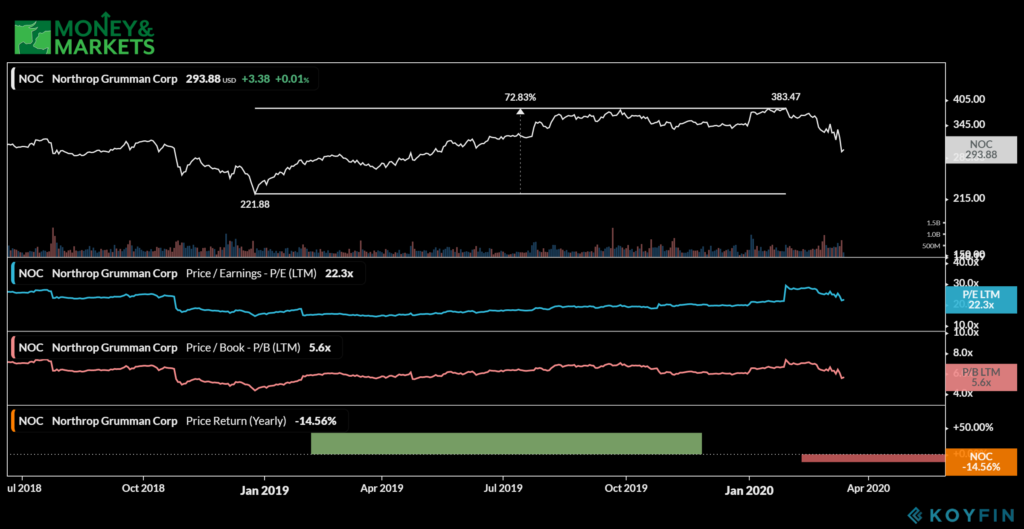

Northrup Grumman shares jumped more than 72% from the end of 2018 through January 2020. It also suffered a drop when markets turned bearish, but the dip was still above the company’s 52-week low.

It has a low price-to-book ratio of 5.6 and a price-to-earnings ratio of 22.2, meaning the value of Northrup Grumman stock is still there.

But the huge tailwind coming from the sale of the B-21 Raider bomber is going to give investors a lot of reasons to smile in the coming years.

That’s why Northrup Grumman is one of three defense stocks to buy in 2020.

With defense spending on the rise, companies producing weapons for the U.S. military are going to benefit. Of course, sales projections don’t take into account the potential for overseas sales.

Selling to other countries will only increase profits more and help line investor’s pockets.

That’s why it’s important to take a look at these three defense stocks to buy in 2020.

Editor’s note: Looking for stocks to buy not on our list or have some good suggestions? Let us know in the comments section below.

Related:

- 3 Stocks to Buy in a Bear Market — Now to Capitalize When Markets Turn South

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 5 5G ETFs to Buy Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020