From the start of 2018 to its lowest point in March 2020, the Energy Select SPDR Fund (NYSE: XLE) dropped 67.4%.

Energy stocks were, quite simply, the bottom of the stock market barrel.

Since that low, however, energy stocks have roared back. XLE climbed 288.2% since hitting that bottom in March 2020:

With uncertainty surrounding European and North American energy today, I’m confident the sector isn’t done moving higher.

That’s why, today, I’m diving into our Stock Power Ratings system to find the three highest-rated energy stocks to buy as the bear market continues.

Top 3 Energy Stocks to Buy Now

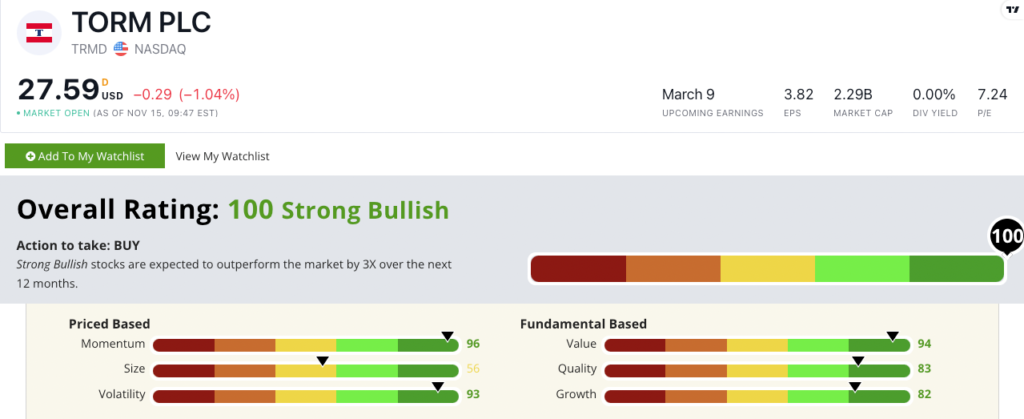

Torm PLC (Nasdaq: TRMD)

The first stock on the list is no stranger to Stock Power Daily readers.

I covered Torm PLC (Nasdaq: TRMD) in a September report. (Click here to read my coverage.)

This is a midstream oil and gas company — meaning it focuses on processing, transporting and marketing oil and natural gas products.

TRMD owns and operates tankers used to transport oil and natural gas from upstream miners to downstream refiners.

Torm stock scores a “Strong Bullish” 100 on our Stock Power Ratings system. It’s jumped two points since I covered it. We expect it to beat the broader market by 3X in the next 12 months.

TRMD is an excellent value stock — earning a 94 on that factor.

Its price-to-earnings ratio is less than half the industry average.

Since I covered the stock in September, it’s jumped another 36.4%. Congratulations on your gains if you got in on this energy stock to buy.

On top of that, TRMD has a forward dividend yield of 20.9%, paying you $5.84 per share per year.

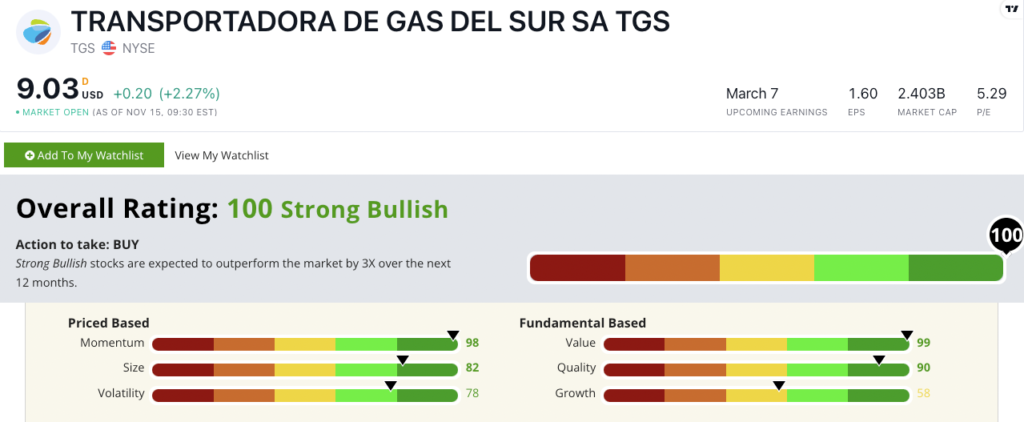

Transportadora de Gas del Sur TGS SA (NYSE: TGS)

For our second stock, we head to South America.

Transportadora de Gas del Sur TGS SA (NYSE: TGS) is an Argentinian company that produces and sells natural gas all over the continent.

I first covered TGS in September. (To read my analysis, click here.)

Natural gas makes up 63% of all of Argentina’s electricity production, putting TGS in the driver’s seat to generate even more gains.

Transportadora stock scores a “Strong Bullish” 100 on our Stock Power Ratings system. It’s one point higher than when I first covered it. We expect it to beat the broader market by 3X in the next 12 months.

Like TORM, TGS is a fantastic value stock — scoring a 99 on that factor.

Its price-to-sales, price-to-cash flow and price-to-book value ratios are all nearly three times lower than the midstream energy sector.

Since I covered TGS in late September, the stock rose 22.9%. Again, congratulations on your gains if you made the play when I told you about it.

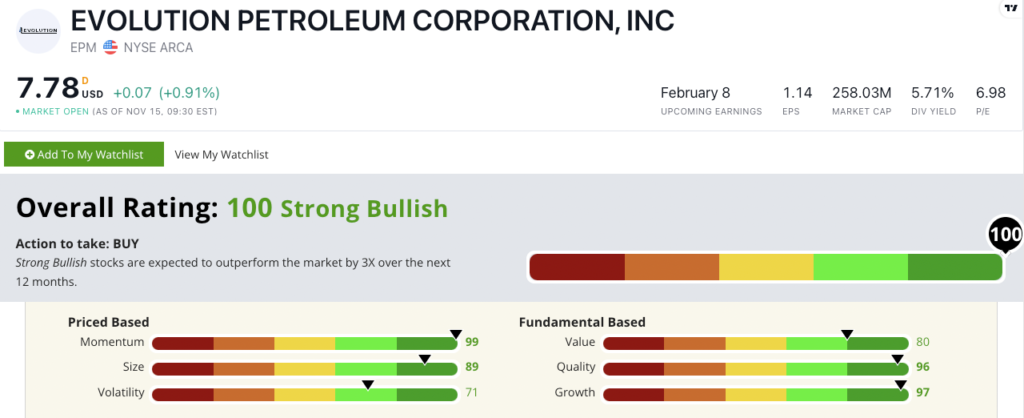

Evolution Petroleum Corp. (NYSE: EPM)

Our final top energy stock explores oil and gas in Wyoming, Louisiana and Texas.

Houston-based Evolution Petroleum Corp. (NYSE: EPM) owns properties in the Delhi oil fields (Louisiana), Barnett Shale (Texas) and Hamilton Dome (Wyoming).

The company’s strategy is to locate property with long-term potential to produce oil and gas.

Evolution Petroleum stock scores a “Strong Bullish” 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

While TORM and TGS are great value stocks, EPM excels as a quality and growth play.

Its one-year annual sales growth rate is 233.1%, and its earnings-per-share growth rate is 290.4% — earning it a 97 on our growth factor.

EPM’s return on assets is 33.2% compared to the fossil fuels exploration industry average of 8.3%. The company’s return on assets is more than double the peer average.

That’s why EPM earns a 96 on our quality factor.

Over the last 12 months, EPM stock has climbed 44.3%!

Not to mention, EPM has a forward dividend yield of 6.23%, paying you $0.48 per share, per year.

Top 3 Energy Stocks to Buy: The Bottom Line

The energy sector has screamed ahead since the corona crash of 2020.

I’m confident that it’s not done moving up.

That makes these three high-rated energy stocks to buy serious contenders for your portfolio.

And if you want to know more about the renewable energy mega trend…

My colleague Adam O'Dell’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).

Stay Tuned: A Coffee Shop Power Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify! And sometimes I like to highlight stocks to avoid.

Stay tuned for the next issue, where I’ll share all the details on a coffee shop stock that’s struggling post-initial public offering.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets