If you are like millions of other Americans, there’s a good chance you’re working from home or remotely to help curb the spread of the coronavirus, so now is a great time to take a look at work-from-home stocks to consider amid the COVID-19 outbreak.

Countless companies across the country have directed their employees to work from home for an undetermined amount of time because of the COVID-19 spread.

Alphabet Inc. (Nasdaq: GOOG), Twitter Inc. (NYSE: TWTR), Facebook Inc. (Nasdaq: FB) and Amazon.com Inc. (Nasdaq: AMZN) are among those companies.

But in order to work from home, there are programs and tools required so productivity doesn’t take a major hit.

Because those tools are going to see a major jump in usage, here are a few work-from-home stocks to take a look at.

Work-From-Home Stocks to Buy Amid Coronavirus

1. DocuSign Inc.

Market Capitalization: $12 billion

Annual Sales (2019): $973 million

Dividend Yield: 0.0%

I’ve been high on electronic agreement company Docusign Inc. (Nasdaq: DOCU). It was one of our four stocks to buy and hold in 2020 and one of five tech stocks to buy in 2020.

It offers its e-signature platform to sectors ranging from government to health care. Businesses can send agreements or any other document that requires a signature to employees and other companies electronically.

That’s what makes it a critical platform for companies to use when employees have to work from home.

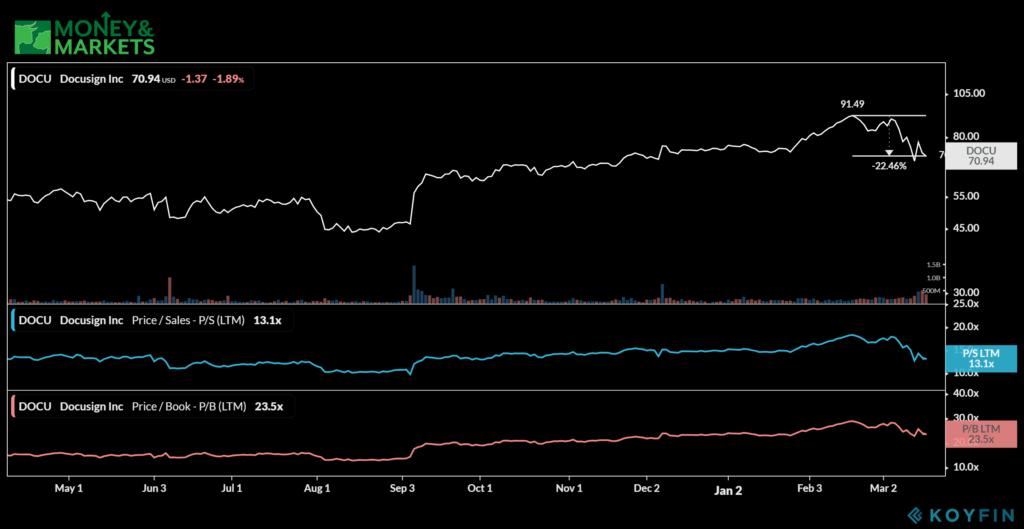

While many companies have dropped between 40% and 60% during the market meltdown that is nearly one month old, DocuSign has limited those losses to just 22%. That’s because as companies move to a work-from-home mentality, Docusign is going to see increases in subscriptions.

In Q4 2019, the company posted earnings of $0.12 per share compared to estimates of $0.03 per share.

Despite the stock’s dip, its price-to-sales ratio is 13.1, and its price to book is 23.5. It’s still trading well above its 52-week low.

As more and more companies move their employees to work remotely, Docusign subscriptions and usage are only going to increase.

That’s why Docusign Inc. is one of our one of the work-from-home stocks to buy in 2020.

2. Zoom Video Communications

Market Capitalization: $30 billion

Annual Sales (2019): $622 million

Dividend Yield: 0.0%

Businesses will still want to communicate with their teams, even if they are all working from home.

Zoom Video Communications (Nasdaq: ZM) provides video and web conferencing platforms using the cloud to do just that.

The software also works across various operating systems, from Mac to Windows and Android.

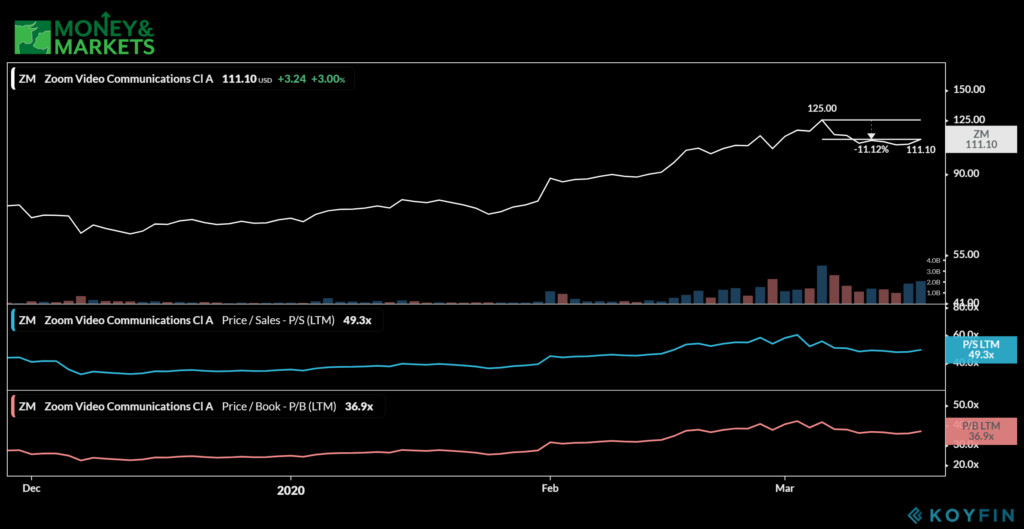

Since its initial public offering in April 2018, shares of Zoom have been relatively consistent. It did start to dip a bit in September 2019 but rebounded 101% into 2020.

The March drop for Zoom has been minimal — only 11% — meaning it seems to have the power to weather the negative market downturn.

Like DocuSign, as companies continue to have employees work remotely, they will still want to remain in contact to ensure productivity. That is where Zoom will play a big role.

That is the reason why Zoom Video Communications is one of our work-from-home stocks to buy in 2020.

3. Ringcentral Inc.

Market Capitalization: $14 billion

Annual Sales (2019): $902 million

Dividend Yield: 0.0%

One company that has provided huge returns for investors is Ringcentral Inc. (NYSE: RNG).

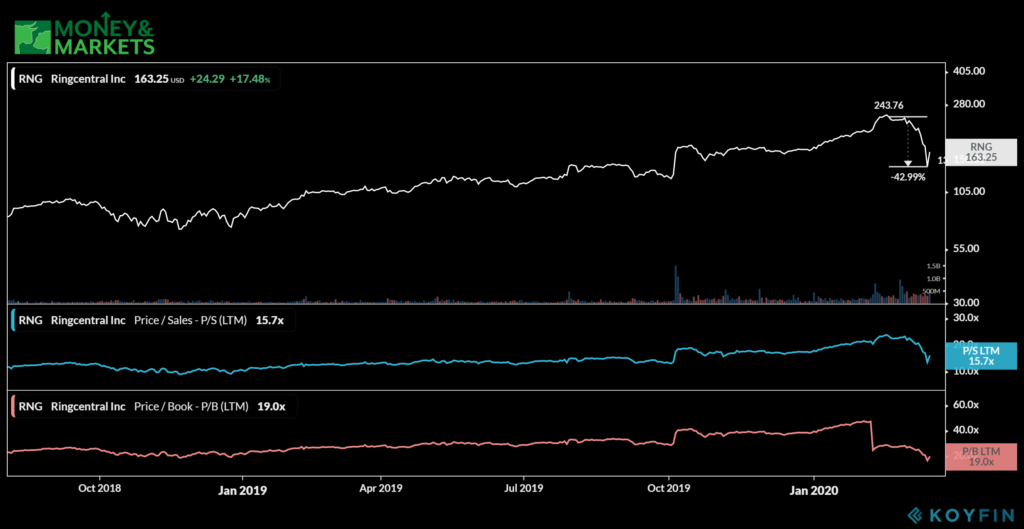

Its five-year return is 958% while its five-year earnings growth is 73%.

The company provides cloud-based call routing, auto-receptionist and powerful integration with smartphones. That makes it a must-have for many remotely staffed businesses.

Before stocks cratered over the past month, Ringcentral was consistently trending up. In 2019, shares of Ringcentral grew by 217% as businesses realized its importance in the marketplace.

The recent dip saw the company shed 43% off its share price, but it’s still above its 52-week low.

With its ability to keep employees connected and collaborating, Ringcentral Inc. is one of our work-from-home stocks to buy in 2020.

4. Dropbox Inc.

Market Capitalization: $7 billion

Annual Sales (2019): $1 billion

Dividend Yield: 0.0%

If you are working from home, it’s likely you still need to share and collaborate on documents and other materials.

That’s where Dropbox Inc. (Nasdaq: DBX) comes in.

Dropbox allows users to store and share documents, videos, music, images and just about any other file type on its cloud-based platform.

It also has a premium version that gives employees the availability to work on files even if they don’t have an internet connection. The files will automatically sync once the user connections back to the internet.

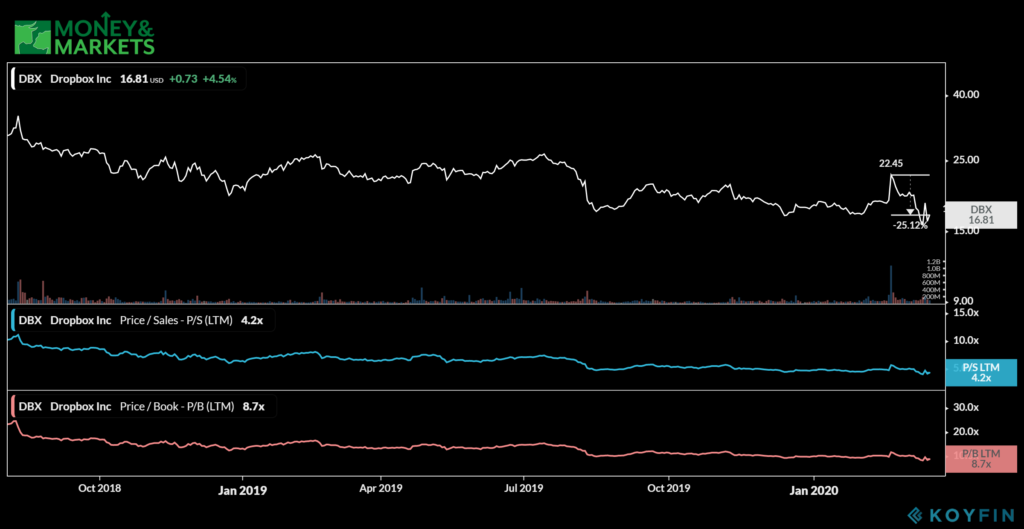

Dropbox traded pretty flat after suffering a drop in August 2019. It spiked in February 2020 but then fell about 25% since then, along with markets in general.

However, its shares are trading at a price to sales of 4.2 and a price to book of 8.7, making it a great value for investors.

As businesses continue to realize the need to maintain document workflow with employees working remotely, Dropbox will recoup those losses.

That’s what makes Dropbox Inc. one of our work-from-home stocks to buy in 2020.

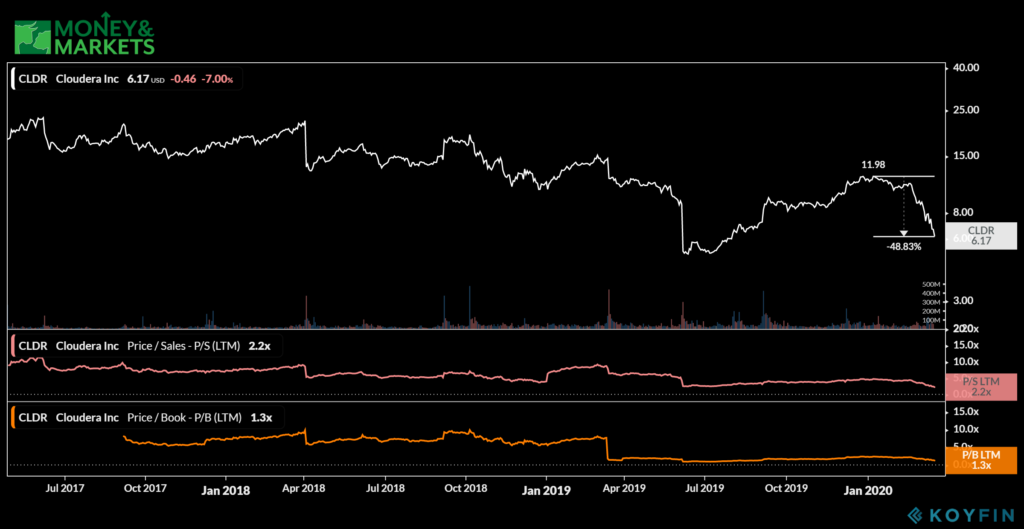

5. Cloudera Inc.

Market Capitalization: $7 billion

Annual Sales (2019): $1 billion

Dividend Yield: 0.0%

Being able to analyze and protect data will still be at the top of business’ minds as employees continue to work remotely.

One of the strongest in this sector is Cloudera Inc. (NYSE: CLDR).

The company specializes in developing software for business data that includes storage, access, management and analysis. And it’s all offered through the cloud, which means employees can access the data they need from anywhere.

Cloudera stock jumped 131% from June 2019 to March 2020. But like many other stocks, it was negatively impacted by the recent bear market drop. It has fallen nearly 49% since the beginning of March.

However, its price to sales is still 2.2, and its price to book is 1.2. Cloudera’s current share price is still above its 52-week low.

As businesses continue to need access to critical data in tough times, Cloudera subscriptions will continue to grow.

That’s why Cloudera Inc. is one of our work-from-home stocks to buy in 2020.

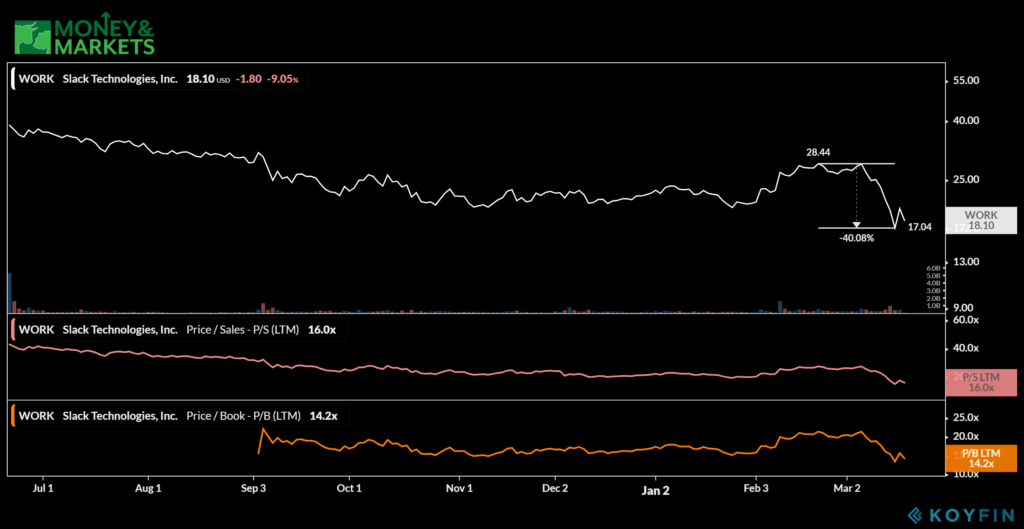

6. Slack Technologies Inc.

Market Capitalization: $10 billion

Annual Sales (2019): $630 million

Dividend Yield: 0.0%

Another remote communication platform to consider is Slack Technologies Inc. (NYSE: WORK).

The company provides chat, video and file sharing in one dashboard. That dashboard works with Mac and Windows platforms.

You can organize teams and communicate with individuals within those teams from a single window.

Shares of Slack struggled to take off in 2019, trading mostly flat.

Since the market drop in March, its stock has fallen 40%. However, its value is still there as its price to sales is 16 and its price to book is 14.2.

The need for solid communication with remote-working employees will continue to be essential for business.

That’s why Slack Technologies Inc. is one of the work-from-home stocks to buy in 2020.

Companies from those who provide audio and video services to document-sharing platforms should all see a strong surge as millions of people work from work from home — and who knows for how long amid the coronavirus global pandemic.

So these are our work-from-home stocks to buy in 2020. As is always the case, do your own due diligence before buying any stocks, particularly in crazy, unprecedented times like we’re now going through.

Editor’s Note: Looking for stocks to buy not on our list? Let us know in the comments below.

Related

- 4 Artificial Intelligence ETFs to Buy Now

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020