The novel coronavirus pandemic has caused significant volatility in global markets, but it’s also helped shine a spotlight on the best health care stocks to buy in 2020.

Investors continue to worry about the spread of the coronavirus as stocks have swung back and forth the past several weeks.

That volatility isn’t likely to stop until there is an end to the COVID-19 spread worldwide — and even better, when there’s a vaccine.

But there are companies out there that will see their bottom line grow amid the ongoing market panic.

Here are the four health care stocks to buy in 2020.

4 Health Care Stocks to Buy in 2020

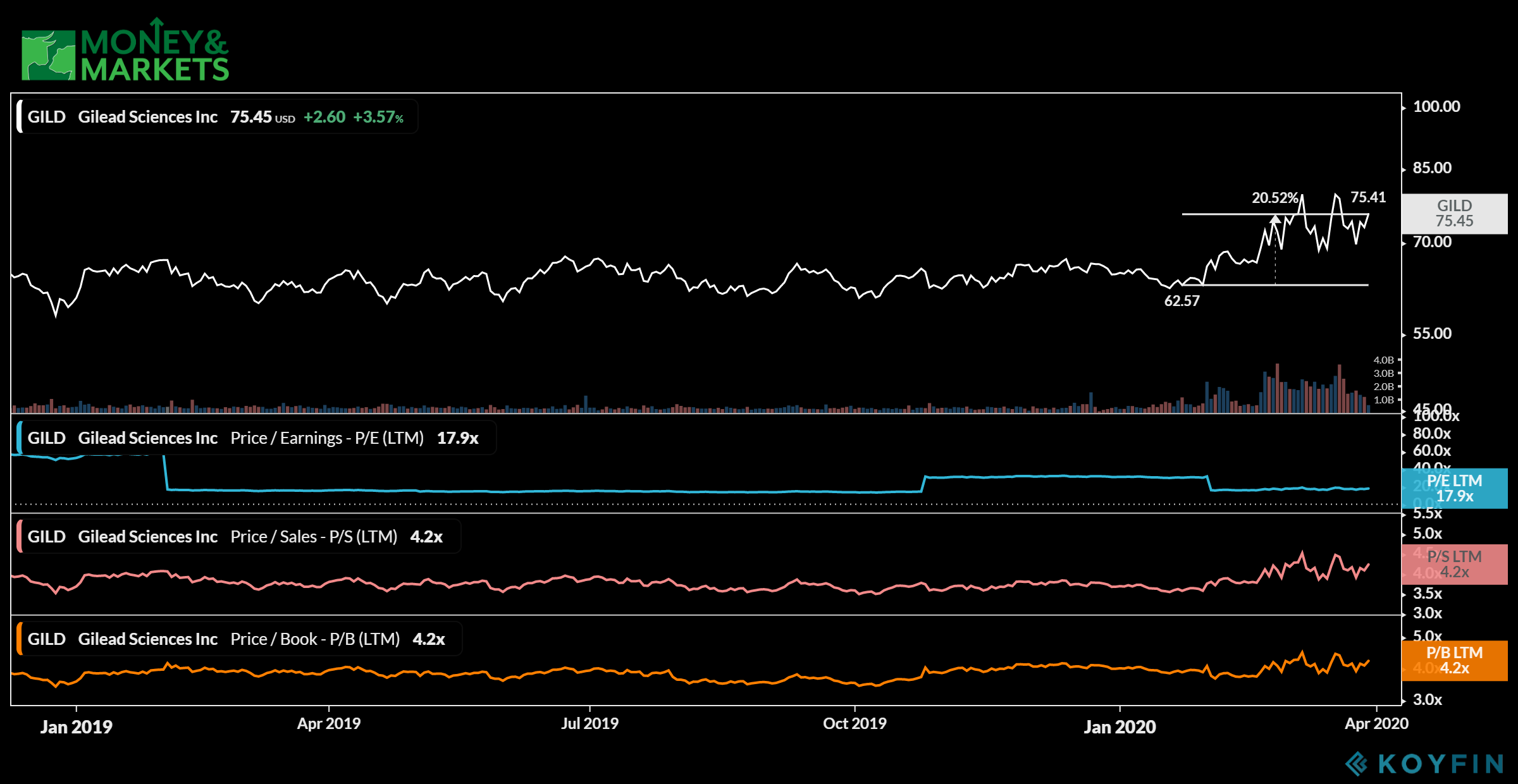

1. Gilead Sciences Inc.

Market Capitalization: $91 billion

Annual Sales (2019): $22 billion

Annual Dividend Yield: 3.73%

There are several companies rushing to put a COVID-19 vaccine on the market, but one of the leaders is Gilead Sciences Inc. (Nasdaq: GILD).

The company recently announced it is expanding access to its experimental remdesivir drug. The World Health Organization recently said it was the most promising therapeutic candidate based on existing studies.

Another encouraging factor for Gilead is while it has seen ups and downs in recent weeks, its share price is still 21.5% higher than its previous low set back in late January 2020.

Its bounces have also been less dramatic than most other equities.

Currently, Gilead trades at a price to sales of 4.2 and a price to book of 4.3. Add in its price to earnings of 17.9 and the company is a solid value.

On top of that, it also pays a strong dividend to shareholders. Its last payment was $0.68 per share.

But the potential of its remdesivir drug makes Gilead Sciences Inc. one of the four health care stocks to buy in 2020.

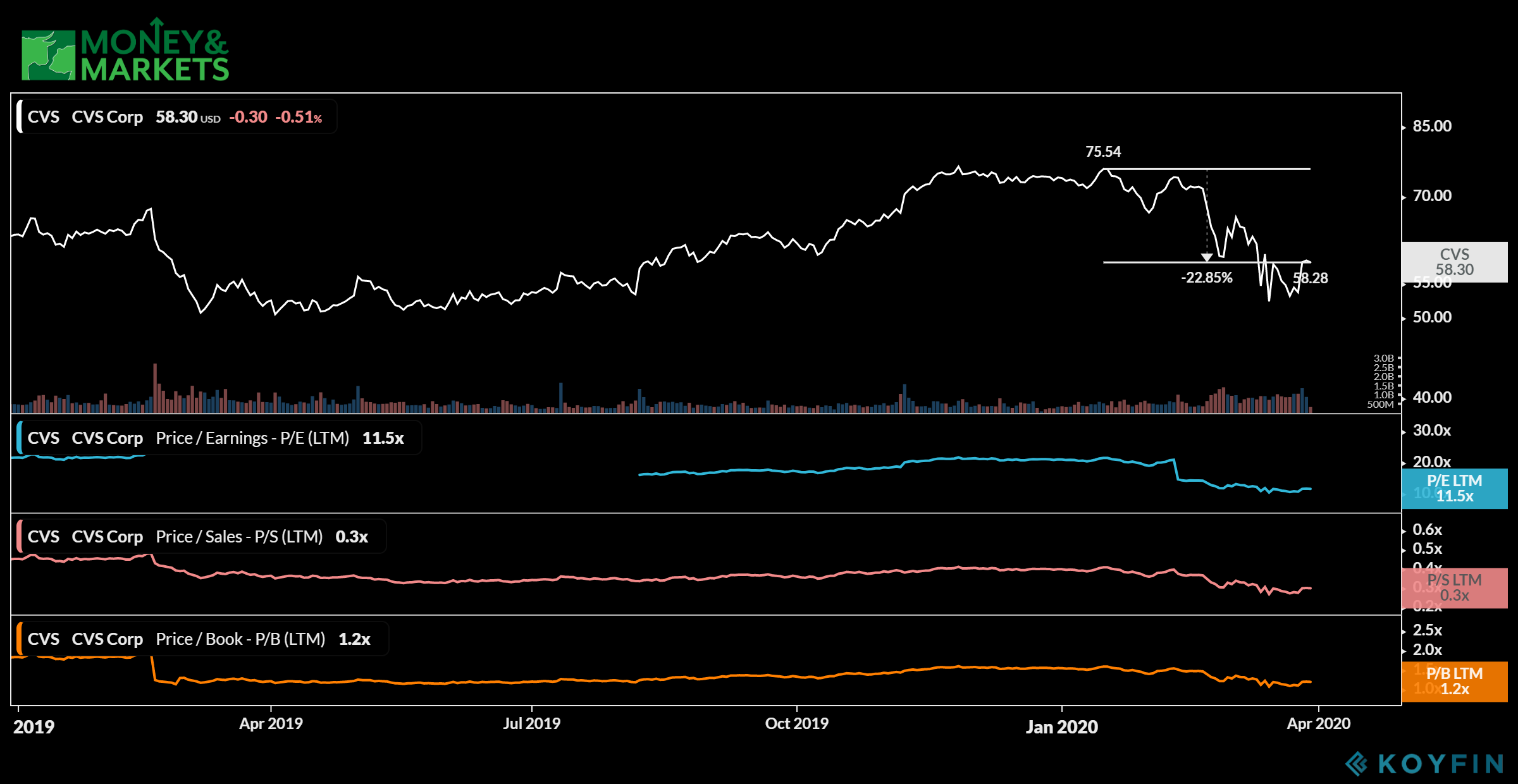

2. CVS Corp.

Market Capitalization: $76 billion

Annual Sales (2019): $256 billion

Annual Dividend Yield: 3.41%

If there is a pharmaceutical company in the U.S. that’s positioned for strong growth, CVS Corp. (NYSE: CVS) may be it.

In addition to its traditional retail pharmacy operation, CVS has added CVS Caremark — a pharmacy benefits manager — and health insurance provider Aetna to its portfolio.

It’s those additions that have kept CVS Corp. from hitting the same dramatic lows other stocks have suffered from.

Since the middle of January, shares of CVS have fallen 22.8%, but they are still trading above their 52-week lows. They also have a lot of growth potential being 24.5% below its 52-week low.

CVS also provides investors with strong value. It’s price to sales is 0.3% and its price to book is 1.2. The recent dip has pushed its price to earnings to 11.5, indicating a good price for the stock.

Like Gilead, CVS has a strong dividend. Its annual dividend yield was 3.41% and its most recent payout was $0.50 per share.

The fact that it is so diversified in the pharmacy and health care space makes CVS Corp. one of the four health care stocks to buy in 2020.

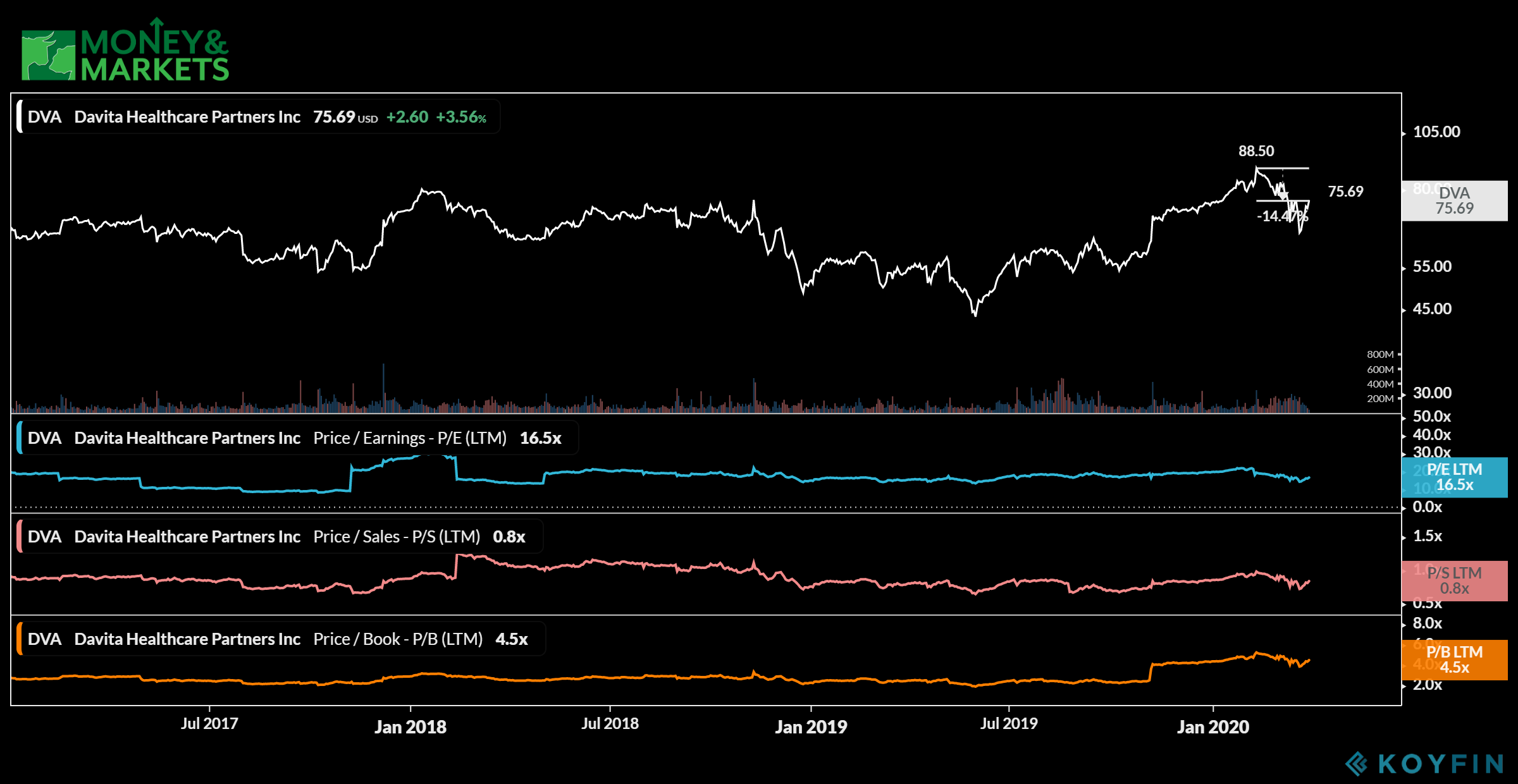

3. Davita Healthcare Partners Inc.

Market Capitalization: $9 billion

Annual Sales (2019): $11 billion

Annual Dividend Yield: 0.0%

While it’s one of the smaller companies by market capitalization, Davita Healthcare Partners Inc. (NYSE: DVA) is one of the world’s leading dialysis companies.

It currently has operations in the U.S. and 10 other countries.

Kidney disease is caused by other chronic illnesses like diabetes. Kidney issues can also be related to being overweight.

Like CVS and Gilead, Davita has dropped. But the stock is just 14.4% off its most recent high set back in mid-February.

Davita’s current price to earnings is 16.5 while its price to sales is 0.8. The company’s price to book is 4.5, making it a good value for potential investors.

While it’s not related to coronavirus, Davita is positioned to just get stronger. As more and more people require treatment for kidney diseases, companies like Davita will be a solution.

That’s why Davita Healthcare Partners Inc. is one of the four health care stocks to buy in 2020.

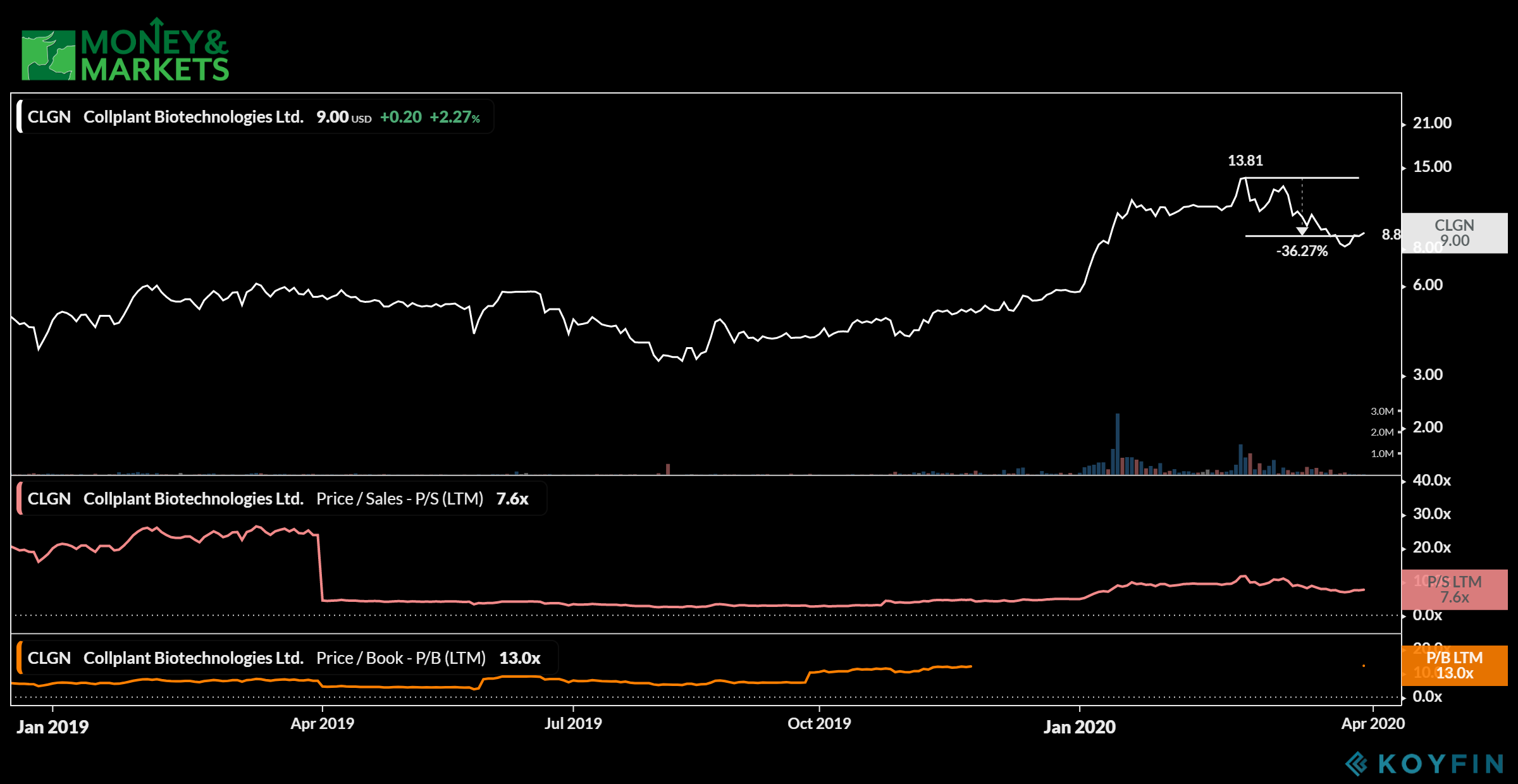

4. Collplant Biotechnologies

Market Capitalization: $33 million

Annual Sales (2019): $4 million

Annual Dividend Yield: 0.0%

The final company on our list does some pretty extraordinary things with bioprinting.

Israeli-based Collplant Biotechnologies (Nasdaq: CLGN) uses plant-based collagen to create replacement organs and tissues. The collagen it uses is almost a direct match to what the body produces, so there are few issues with rejection.

It has also signed an agreement to use 3D printing to reproduce those organs.

Collplant has also had a dip in its share price — to the tune of around 36%, but for a company on the cutting edge of medical technology, it is extremely cheap to invest in.

Currently, shares of Collplant trade at around $9, which is about $4 under its 52-week high, but still well-above its lowest point.

Its price to sales is 7.6 and its price to book is 13. It’s not as big a value as the other companies on the list, but considering what it does and how much it is, it would be hard to resist not buying into it.

That’s why Collplant Biotechnologies is one of the four health care stocks to buy in 2020.

From bioprinting to pharmacies, there are companies poised to make investors strong gains in the coming year.

That’s why it’s important to look at these four health care stocks to buy in 2020.

Editor’s note: Looking for stocks to buy not on our list or have some good suggestions? Let us know in the comments section below.

Related:

- 3 Defense Stocks to Buy in 2020 — Invest in These Bulwark Companies

- 3 Stocks to Buy in a Bear Market — Now to Capitalize When Markets Turn South

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 5 5G ETFs to Buy Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- The 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020