With all three major U.S. indexes falling into correction territory at Thursday’s closing bell on Wall Street, a lot of people, particularly newer traders, might be wondering exactly what is a stock market correction and how long will it last?

What Is a Stock Market Correction?

A stock market correction occurs when a major index like the Dow Jones Industrial Average, S&P 500 or Nasdaq falls 10% or more from a recent 52-week high. This generally occurs because something spooks investors to flee from stocks into more traditional safe-haven assets like bonds or precious metals like gold.

There have now been 27 market corrections including Thursday’s since World War II, and the latest one is due to fears of the spread of the coronavirus, also known as COVID-19, from Wuhan, China, to the rest of the world.

The average correction lasts about four months before bouncing back and usually involve nearly 13% declines.

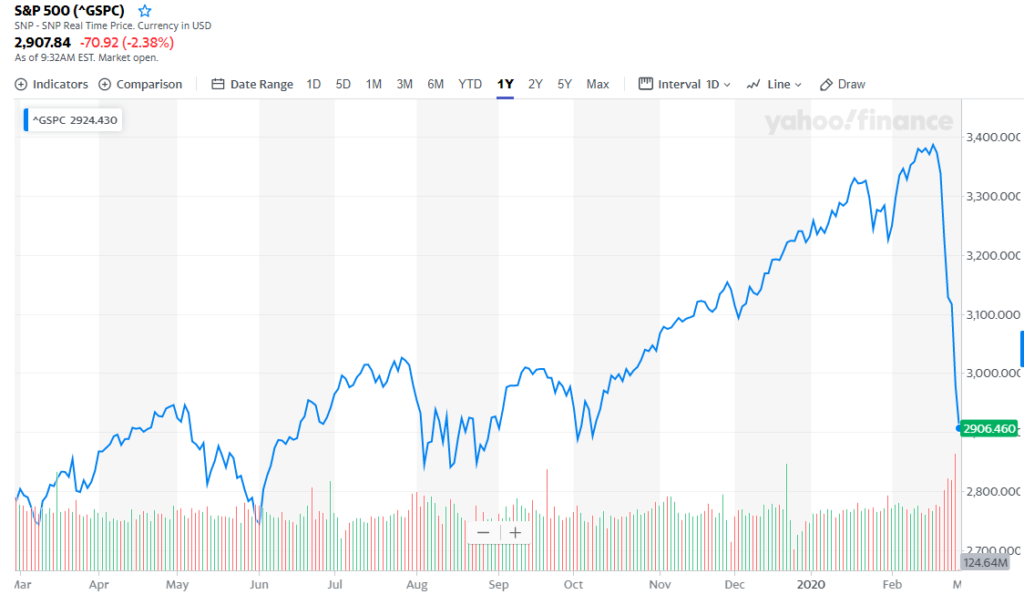

The Dow, which fell a record 1,190 points, and S&P 500 both fell 4.4% on Thursday, pushing them well into correction territory as both indexes are down more than 12% from their recent record-high closings earlier this month.

The Dow sheds 1,196 points today — the worst single-day points sell-off ever.

US stocks are officially in a correction

Dow: -12.8%

S&P 500: -12.1%

Nasdsaq: -12.7%Momentum definitely on the downside for now.https://t.co/PxIifwFWyz via @rachsieg @addedvalueth #stocks

— Heather Long (@byHeatherLong) February 27, 2020

The latest correction in the S&P 500 this week marked the fastest 10% decline in the index’s history.

So that basically entails what a stock market correction is and now the big question looming on Wall Street is whether this correction turns into a full-blown bear market, which is a 20% percent decline.

Whether this correction turns into a bear market is anyone’s guess. As of this morning’s opening bell, markets are again tanking and unless there’s a dramatic turnaround today, this will be the single-worst week for the stock markets since the Great Recession.

Stock indexes around the world entered correction territory and are on track for their biggest weekly losses since 2008. Here’s what we’re watching in the markets today, with @byayeshajaved. #WSJWhatsNow pic.twitter.com/7fu2Arkx6Q

— The Wall Street Journal (@WSJ) February 28, 2020

If this suddenly becomes a bear market, expect a lot more pain ahead. According to CNBC, there have been 12 bear markets since World War II. These bear markets have averaged a whopping 32.5% decline and the most recent one lasted from October 2007 until March 2009. The Great Recession’s bear market and subsequent crash wiped a whopping 57% from market indexes, and it took more than four years to recover.

Bear markets typically last about 14.5 months and take two years to recover from.

Let’s just hope this correction doesn’t fall into a bear market, which looks possible at this point, particularly if the coronavirus isn’t contained soon.

Related:

Yardeni Sits on Cash Fearing 10% Coronavirus Correction

Vanguard Sees 50% Chance of Market Correction in 2020

Long-Time Wall Street Bull: ‘Market Melt-Up’ Threatening Nasty Correction

Bear Market or Correction? Analyst Says Dow Theory Could Hold Key

David Stockman: Trump ‘Playing With Fire,’ 40% S&P 500 Correction

How Bad Can Market Corrections Get and How Long Can They Last?

What Makes the 2018 Stock Market Corrections Different?