Stocks are swinging like pendulums amid record volatility, but a more permanent rebound will happen at some point, which is why it’s important to know the three stocks to buy after the COVID-19 crash.

Businesses around the world are suffering due to the spread of the novel coronavirus. Trimming back expenses, furloughing and laying off employees or even shutting down entirely, few sectors of the economy haven’t been adversely impacted.

As an investor, it raises a lot of questions.

Like whether to sell off, buy the dip or hold your positions.

But it’s also important to look to the future because a rebound from the bear market is going to happen, we just don’t know when.

So here is our list of three stocks to buy after the COVID-19 crash.

3 Stocks to Buy After the COVID-19 Crash

1. Salesforce.com

Market Capitalization: $134 billion

Annual Sales (2019): $17 billion

Annual Dividend Yield: 0.00%

One big adjustment businesses have been forced to make because of the coronavirus crash is having employees work from home. Companies are rushing to sign up with cloud services to allow greater productivity while workers are remote.

Salesforce.com Inc. (NYSE: CRM) is one company that stands to benefit from this shift in work culture.

Salesforce develops and sells customer relations management software to businesses across a wide spectrum.

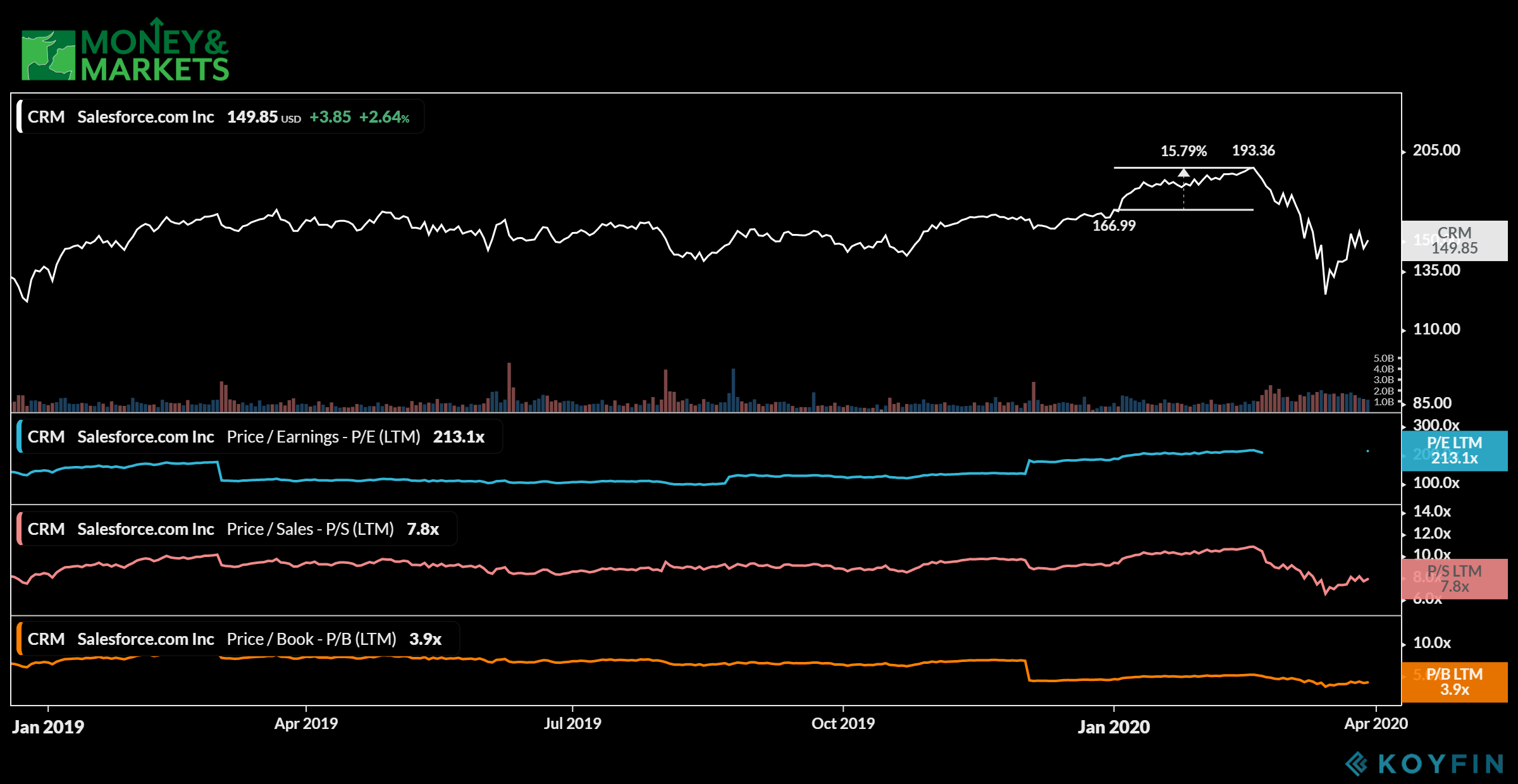

In 2019, shares of Salesforce jumped 21%. It went up another 16% from January 2020 to Feb. 20, 2020, when it reached its 52-week high.

The stock then dropped along with the rest of the market in late February and early March, but has started to rebound thanks to businesses needing its platform for remote work.

Technically speaking, its price to earnings is high — 213.1 — but its price to sales is 7.8 and its price to book is 3.9. And with the recent dip, Salesforce has a long way to go before reaching its top resistance point — meaning there’s a lot of profit opportunity to be had.

Of note: We also recommended this company as a buy in two other sectors here and here.

Because more and more businesses are flocking to cloud-based software, Salesforce.com Inc. is one of the three stocks to buy after the COVID-19 crash.

2. Alibaba Group Holding

Market Capitalization: $486 billion

Annual Sales (2019): $56 billion

Annual Dividend Yield: 0.00%

Before the COVID-19 crash started in China, Alibaba Group Holding (NYSE: BABA) was having a massive growth spurt.

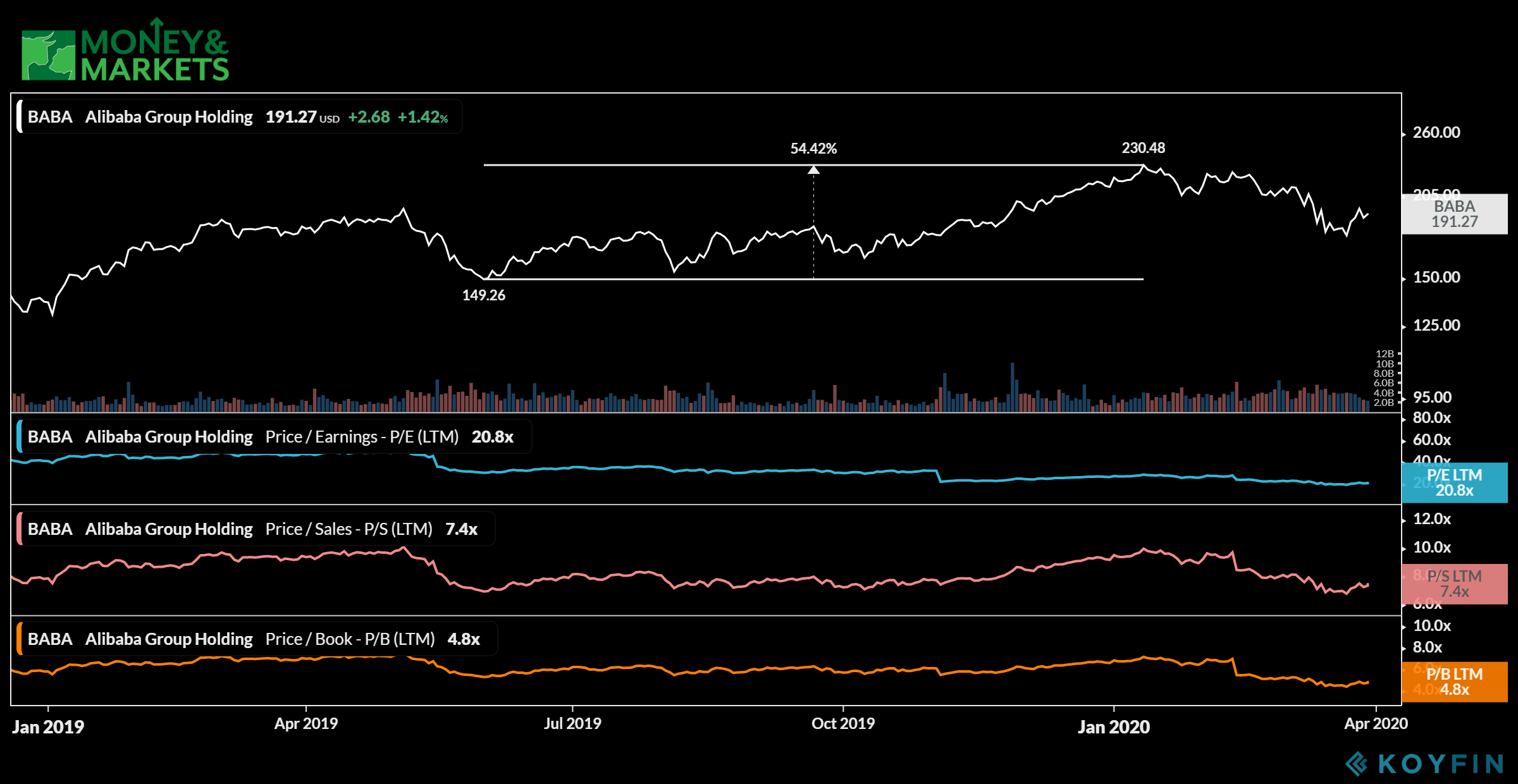

The Chinese Amazon saw its share price jump more than 54% from the summer of 2019 to January 2020.

Alibaba’s fall since reaching a high on Jan. 13, 2020 has not been nearly as bad as most companies. In fact, when it reached its lowest point of the coronavirus dip, it was only 18% off that 52-week high.

Despite quarantines around the globe, people still need to shop — whether it is for essential items or not. And, as Alibaba continues to expand into other markets in Asia and around the world, it stands to take off once investors jump back into the market.

The company is currently trading a price to earnings of 20.8, a price to sales of 7.4 and a price to book of 4.8. Like Salesforce, it’s not anywhere close to its bottom, but still has a long way to reach its top.

Its growth has been so strong, we also recommended it in a couple of other segments here and here.

That’s why Alibaba Holding Group is one of the three stocks to buy after the COVID-19 crash.

3. Nvidia Corp.

Market Capitalization: $162 billion

Annual Sales (2019): $10 billion

Annual Dividend Yield: 0.24%

One thing is certain: Coronavirus or not, artificial intelligence and its uses will continue to expand.

A company that stands to gain from that expansion is Nvidia Corp. (Nasdaq: NVDA).

The company made its bones with its graphics processing units (GPUs) — microchips that process huge amounts of data in a cost-effective manner. But recently, Nvidia found that those GPUs have a place in artificial intelligence.

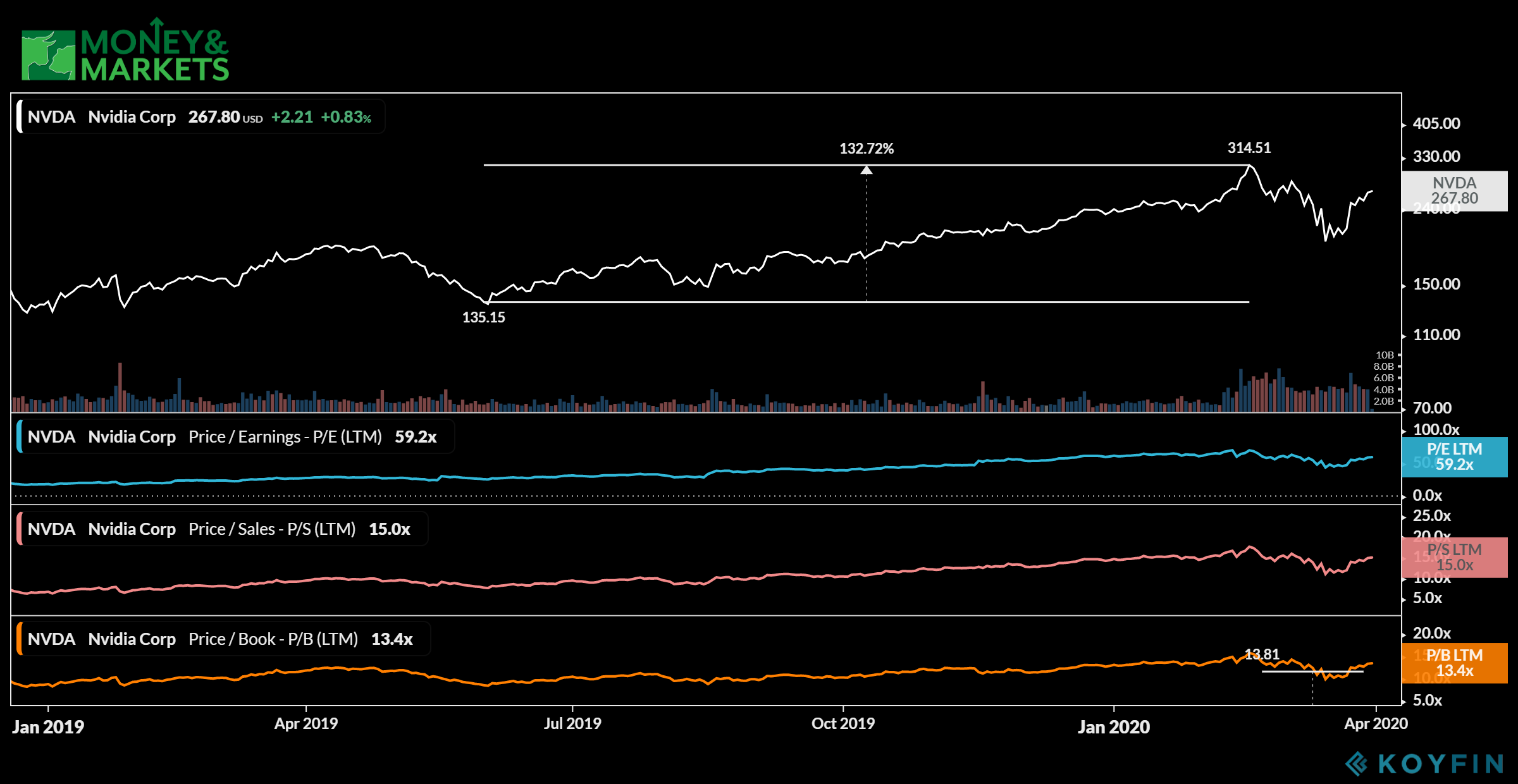

From June 2019 to February 2020, Nvidia’s shares grew more than 132% thanks to its strong balance sheet and development into the AI sector.

The COVID-19 crash cut that stock price by 30%, but the company has rebounded and pared those losses in half in short order.

The only real drawback is Nvidia has a forward price-to-earnings ratio of 59.2x, which is high. However, this is a massive industry and Nvidia remains one of the market leaders.

Sales of its GPUs are likely to expand as Nvidia branches out to sell to data centers and self-driving vehicles. That’s why Nvidia Corp. is one of the three stocks to buy after the COVID-19 crash.

Of note: We also recommended Nvidia as one of our top AI stocks to watch in 2020.

From cloud computing to retail and artificial intelligence, these companies provide great growth potential. Some have even started back on the track of rebounding from the coronavirus crash.

These companies have the ability to be market game-changers, which is why they are our three stocks to buy after the COVID-19 crash.

Editor’s note: Looking for stocks to buy not on our list or have some good suggestions? Let us know in the comments section below.

Related:

- 3 Defense Stocks to Buy in 2020 — Invest in These Bulwark Companies

- 3 Stocks to Buy in a Bear Market — Now to Capitalize When Markets Turn South

- 6 Stocks to Buy and Hold for the Next Decade

- 3 Gold Stocks to Buy Now — Investing in the Precious Metal

- What Is the Best S&P 500 ETF to Buy?

- 3 Cheap 5G Stocks to Buy Right Now

- 5 5G ETFs to Buy Now

- 6 5G Dividend Stocks to Buy Now

- 4 Tech Dividend Stocks to Buy Now

- The 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 7 5G Stocks to Buy Right Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020